Inflation Is Here To Stay: Don't be fooled by those talking heads on television. The inflation we are witnessing is neither temporary nor transitory.

Recently it was announced that energy costs for electric customers are going up by as much as 50% across Pennsylvania. General Mills informed its retail customers that prices would rise about 20% on hundreds of its items throughout dozens of its brands in mid-January. Dollar Tree has increased prices by 25%. Bidenflation is going to skyrocket next year and it looks like things may be worse than during the Carter administration.

Scott Grannis recently wrote, "The Fed, not supply chain bottlenecks, is to blame for a significant rise in inflation. If the Fed were targeting low and stable inflation correctly, supply chain bottlenecks would result in an increase in some prices, but not all. Think of stable monetary policy as putting the economy on a fixed spending budget; if you spend more on some things, you perforce need to spend less on others.

Today, consumers have a super-abundant spending budget which is allowing a wide variety of price increases, some of which are sizable. (How many prices are declining these days? Offhand, I can't think of any.) This inflation episode is not transitory, it is semi-permanent, and it will last until the Fed decides to tighten monetary policy, an event which still resides uncomfortably far into the future.

Unfortunately for Biden, his administration will carry the burden of the blame for higher inflation; unfortunately for consumers, they will carry the burden of paying for the Fed's mistake."

"So here we are today: despite all its exhortations to the contrary, the Fed has made an inflationary mistake which it's very unlikely to correct anytime soon. (In fact, monetary policy has never been so easy.) And despite the economy's rather impressive recovery this past year (both real and nominal GDP are now higher than just before the covid shutdowns began), the market remains convinced that the future of economic growth is bleak."

Scott is "more pessimistic than the market about the outlook for inflation" but "more optimistic about the outlook for growth. As a result, I'll stick with "borrow and buy" until real interest rates rise significantly. I'll avoid cash and embrace debt; I'll be a seller of bonds rather than a buyer; and I'll be a buyer of property and equities."

I am very concerned about the financial condition of the U.S. The current situation has the feel of the inflation I personally experienced during the 1970s and early '80s. I saw the results of the excesses of the 1960s when Lyndon Johnson's failed and expensive Great Society program was launched just as the cost of the Vietnam War was escalating. We paid for these excesses in the 1970s. Nixon took us off the gold standard. Then he cranked open the money supply in an attempt to delay the inevitable recession until after his 1972 reelection. The 1973 oil crisis further strangled the economy, resulting in the 1974-75 recession and subsequent anemic recovery. Inflation continued, even as the U.S. economy stagnated. Nixon didn't fix it. Nor did Jerry Ford with his Whip Inflation Now buttons. Nor Jimmy Carter. In 1978, the consumer price index had gone up by 9%. In 1979, it rose 13.3%.

I am very concerned about the financial condition of the U.S. The current situation has the feel of the inflation I personally experienced during the 1970s and early '80s. I saw the results of the excesses of the 1960s when Lyndon Johnson's failed and expensive Great Society program was launched just as the cost of the Vietnam War was escalating. We paid for these excesses in the 1970s. Nixon took us off the gold standard. Then he cranked open the money supply in an attempt to delay the inevitable recession until after his 1972 reelection. The 1973 oil crisis further strangled the economy, resulting in the 1974-75 recession and subsequent anemic recovery. Inflation continued, even as the U.S. economy stagnated. Nixon didn't fix it. Nor did Jerry Ford with his Whip Inflation Now buttons. Nor Jimmy Carter. In 1978, the consumer price index had gone up by 9%. In 1979, it rose 13.3%.

By mid-1980, the prime rate was over 20%. Unsecured personal loans were actually cheaper at Household Finance Corporation than small business loans were at my local banks in those days. Ronald Reagan quickly put a stop to this madness. Only then was inflation reduced … slowly.

This is what happens when you spend money you don't have - when you run your banking system like a dysfunctional three-card monte game, outsource all your subassemblies to Asia, close plants in Indiana and Michigan and move production to Mexico, close the tech support center in California and open one in Bangladore ... and vote for politicians who enact policies which make the aforementioned business actions the sensible thing to do.. The government does so by printing money. The United States is more than $29 trillion in debt – about 130% of the country's annual gross domestic product.

The government loves inflation. Noted black economist Thomas Sowell once wrote, "Inflation is a quiet but effective way for the government to transfer resources from the people to itself, without raising taxes." Inflation keeps growing but Congress won't stop spending. Looting of the treasury is the final stage of a failing nation. (posted 12/2/21, permalink)

Uh Oh:

Stock market crash ahead? The above graph looks ominous. And there's more - Bank of America has joined the "dead for the long term" party. BofA now projects that the S&P 500 will return somewhere between zero and a bit below zero annually for the next ten years. The last time the bank made such a forecast was in 1999. Says BofA, "We see dividend preservation and growth as the single most important criteria for stock selection, which could potentially be the difference between a flat-to-negative and positive return over the next 10 years in the S&P 500."

That prediction is in line with Research Affiliates' projection of a negative 0.5% annual return for the broad US stock market and wildly more optimistic than global investment advisory firm, Grantham, Mayo and Van Otterion's regression-driven estimate of negative 7% annual returns for the next seven years. (posted 11/4/21, permalink)

More Signs Of Inflation: Maz Woolley of the British publication Model Auto Review wrote recently about "the continued inflated shipping charges for containers from Chinese ports to other countries. In the case of shipments to the UK these are now up to six times the cost that they were before the covid pandemic and worryingly show little sign of lowering soon. An additional worry is that even at these inflated prices shipments are often delayed in China waiting for ships to arrive back to ship the containers."

He continued, "Looking at the model railway sector, which is closely allied to model vehicles, announced models have been delayed but there has also been a huge rise in the prices charged by some makers for the latest models. Models with minor moulding and livery changes are being launched at nearly twice the price of earlier versions of the same moulding. That type of price rise cannot be explained by additional shipping costs. Some collectors are now simply not buying new ready to run offerings as they see them as too expensive and poor value for money."

Economist Nouriel Roubini wrote, "In April, I warned that today's extremely loose monetary and fiscal policies, when combined with a number of negative supply shocks, could result in 1970s-style stagflation (high inflation alongside a recession). In fact, the risk today is even bigger than it was then.

After all, debt ratios in advanced economies and most emerging markets were much lower in the 1970s, which is why stagflation has not been associated with debt crises historically. If anything, unexpected inflation in the 1970s wiped out the real value of nominal debts at fixed rates, thus reducing many advanced economies’ public-debt burdens."

Break out your old disco eight-tracks and an avocado shag rug - it's the 1970s again. (posted 7/12/21, permalink)

U.S. Currency No Longer Sound:

Although ... it's still better than Bitcoin. (posted 6/25/21, permalink)

Inflation Alert: I am very concerned about the financial condition of the U.S. The current situation has the feel of the inflation I personally experienced during the 1970s and early '80s.

Inflation Alert: I am very concerned about the financial condition of the U.S. The current situation has the feel of the inflation I personally experienced during the 1970s and early '80s.

Recently, analysts at JPMorgan Chase & Co. estimated that the price of an automobile's raw materials have climbed 83% in first three months of 2021. The Bloomberg Commodity Spot Index jumped to its highest since 2011, with metals up 21% so far this year. Other metals, such as copper, silver and platinum have soared. Plywood has just about tripled. Lumber has tripled in price since the beginning of 2021. "$50,000 worth of wood could be used to build 10 homes a year ago. Today it would build only 2."

Wharton professor Jeremy Siegel said inflation could spike to 20% in the next two or three years due to "unprecedented" fiscal and monetary stimulus and an explosion ... (more >>>)

Book Review: 'The Amazon Jungle: The Truth About Amazon, The Seller's Survival Guide for Thriving on the World's Most Perilous E-Commerce Marketplace' by Jason R. Boyce and Rick Cesari

Book Review: 'The Amazon Jungle: The Truth About Amazon, The Seller's Survival Guide for Thriving on the World's Most Perilous E-Commerce Marketplace' by Jason R. Boyce and Rick Cesari

Over the past 50+ years, I've probably read almost a thousand business books. I used to spend several days each month on the road; I often spent my evenings reading books about business. Many books are written by people who are business writers and consultants. When you buy one of their books, you're buying a few hours of their time for a modest price. If you paid for personal, one-on-one meetings with these people, you might spend thousands of dollars. If you attended one of their speeches or seminars, you still might pay hundreds of dollars and only get to hear them for an hour or so. That's why, in my opinion, their books are bargains.

These authors have put their hearts and souls into their books and filled them with valuable information. They provide recommendations and ideas which are based on their experience and expertise. Oh sure, I've read a few books which were not so hot, but I never read a business book that didn't have at least one idea I could use. If the book was a real stinker, I'd tear out and keep the page with the one good idea and throw the rest of the book away. And I'd put that idea to use.

That said, do not throw any parts of this book away. This short book - 212 pages - offers a ton of powerful and practical suggestions about ... (more >>>)

Slow Traffic Ahead: Economist Scott Grannis, who has an admirable track record on economic forecasting, recently wrote, "For 50 years, from 1966 through 2007, the US economy grew at an average annualized rate of about 3.1% - a great and dynamic expansion which saw the economy almost quintuple in size. Then came the Great Recession of 2008-9. Not only did the economy fail to recover to that long-term 3.1% trend in subsequent years - for the first time ever, following a recession - it went on to post only slightly more than 2.1% annual growth in the decade from 2009 through early 2019. It was the weakest economic expansion on record, and it looks set to continue for the foreseeable future, I'm sorry to say."

Slow Traffic Ahead: Economist Scott Grannis, who has an admirable track record on economic forecasting, recently wrote, "For 50 years, from 1966 through 2007, the US economy grew at an average annualized rate of about 3.1% - a great and dynamic expansion which saw the economy almost quintuple in size. Then came the Great Recession of 2008-9. Not only did the economy fail to recover to that long-term 3.1% trend in subsequent years - for the first time ever, following a recession - it went on to post only slightly more than 2.1% annual growth in the decade from 2009 through early 2019. It was the weakest economic expansion on record, and it looks set to continue for the foreseeable future, I'm sorry to say."

"We've been living in a sub-par recovery since I first anticipated it back in early 2009, thanks to too much regulation, high taxes, and too much government spending. Those same forces will act as headwinds for the economy in the years to come, with Biden promising a virtual replay of all of Obama's anti-growth policies - and possibly even more. Slow growth has left the economy substantially weaker and smaller (by about $4.5 trillion per year … than it might have been had the prior 3.1% growth trend persisted."

There is also a demographic shift as Boomers age and buy less, while the U.S. birth rate continues to fall. This sets America up for a Japan-like future - elderly people assisted by robots. Or, in the case of the U.S., low-paid immigrants. This is not the sign of a vibrant economy, especially when America outsources so many good jobs to low-wage countries.

Scott gave appropriate props to President Trump, noting that "the economy perked up a bit in 2018 and 2019 as Trump's policies boosted growth above the 2.1%, a period which culminated in record-breaking real household median income growth." Trump tried very hard to bring businesses back to the U.S., especially manufacturing. He also got rid of a ton of onerous regulations that made doing business in America more costly. (posted 2/19/21, permalink)

Scary Numbers, Scary Times: Institutional investment expert Edward A. Studzinski wrote recently that "we are entering into uncharted territory, since having expanded the money supply by that amount in 2020, President Biden wants to 'go big'. That suggests that the creation of an excess money supply will have a hyperbolic impact on increasing inflation. And that is at a time when we are at a rather dangerous tipping point.

Scary Numbers, Scary Times: Institutional investment expert Edward A. Studzinski wrote recently that "we are entering into uncharted territory, since having expanded the money supply by that amount in 2020, President Biden wants to 'go big'. That suggests that the creation of an excess money supply will have a hyperbolic impact on increasing inflation. And that is at a time when we are at a rather dangerous tipping point.

According to the National Debt Clock at the St. Louis Fed and the Bureau of Labor Statistics, in 2000 Debt per Taxpayer was $55,750; Interest Expense per Citizen was $8,053, and Real Median Personal Income was $32,032.

In 2021, we are at $222,191 Debt per Taxpayer; Interest Expense per Citizen of $14,939; and Real Median Personal Income of $49,217. During that time, Debt has changed annually by 6.81%; Interest Expense on that debt changed annually at 3.00% (a very low interest rate period), and Real Median Personal Income grew at 2.07%.

One last point to scare you with – 20 years ago Federal Government debt was 60% of Gross Domestic Product. Today it is 130%. That is not money that we just owe to ourselves. Rather, other countries have purchased our debt and have a call on it." (posted 2/11/21, permalink)

To Vee Or Not To Vee: Scott Grannis has provided several graphs showing the recovery from the Wuhan flu. Money demand is getting back to normal levels, continuing unemployment claims are trending down and light vehicle sales are showing a true V-shaped recovery.

Air travel is making a much slower recovery - more of a long check-mark shape rather than a V. In Orlando, Florida, airport traffic is down 54% from pre-covid levels, while hotel occupancy has decreased 45%. Convention traffic has reportedly declined by 67%; I'm surprised it's not worse.

The hospitality and travel industries have been decimated. Airlines will take years to recover. Cruise ships are all docked at this point. The rental car biz is in sad shape; Hertz is operating in bankruptcy. Every business involving crowds and close seating will probably change forever. NYC's Broadway shows have been postponed until at least summer of next year. Movie theaters are in trouble. Every ancillary business - from theater program design and printing, movie production, even sales of popcorn - has been adversely affected.

Some firms will recover quickly but many more will have a tougher time. And, sadly, still others will not survive. (posted 10/21/20, permalink)

What's Next? I think few people realize the large degree of harm that the Chinese virus has caused. Aside from the 1.7 million cases in the U.S. (many resulted in serious illnesses) and the almost 100,000 American deaths so far, there is a profoundly grave economic impact that is not yet fully felt. The nation has been on full lockdown for two-plus months; this has caused severe and unprecedented damage to our economy.

The Panglossian idea that everything is going to snap back and return to normal just-like-that is, in my opinion, wishful thinking. Will America's recovery be V-shaped? I doubt it. I'm guessing it will be more of a checkmark-shaped recovery.

Here are my guesses about how specific business sectors will be affected in the near term:

• We are already in a near-Depression (or a Recession of historic proportions), hopefully a short-lived one. Retail sales for April were 22% below last year's figures. I expect the economy to hit bottom in June. The 3rd quarter will show economic improvement and I would expect a strong 4th quarter as America gets ready to celebrate Christmas - in a big way. Nevertheless, it will take years for the unemployment rate to fall to 4-5%.

• We are already in a near-Depression (or a Recession of historic proportions), hopefully a short-lived one. Retail sales for April were 22% below last year's figures. I expect the economy to hit bottom in June. The 3rd quarter will show economic improvement and I would expect a strong 4th quarter as America gets ready to celebrate Christmas - in a big way. Nevertheless, it will take years for the unemployment rate to fall to 4-5%.

• I predict that there will be fewer brick-and-mortar options for shopping and that Americans will turn away from Chinese-made products wherever possible.

• With national unemployment figures exceeding 43 million and continuing to rise, how important do you think big ticket items, such as a new automobile or expensive vacation, are in the grand scheme of things? Especially when food and rent/mortgage payments are in play? Toyota has made a guess - cutting resumed production by one-third as it reopens.

• After two-plus months of zero business, many of America's 30 million small businesses will not survive. Since so many small firms are undercapitalized; a figure of one million business failures in a 12-month period wouldn't surprise me. Those businesses which survive will not be making big-ticket capital goods purchases anytime soon, whether it be a CNC router, a new forklift truck, new signage, a new work truck or a nice new company car. Capital goods manufacturers will be in trouble for a long time.

• Restaurants are a special case - they are low-margin businesses with lots of competition and are therefore fragile business endeavors. There is not a single restaurant that can survive with a 50% occupancy restriction - or even a 75% one. Their fixed costs are simply too high and margins too low. A restaurant association has estimated that 10% of all restaurants may be out of business by the end of May. Steve Hafner, CEO of Booking Holdings' OpenTable and travel site Kaya, predicted that 25% of all restaurants will not reopen after the shutdown regulations are lifted. Besides, who wants to dine at a restaurant where all employees are masked and gloved-up like in an ICU. Talk about negative ambience.

• Read my aforementioned comments about small businesses and try to guess how that would affect the earnings of large companies such a Caterpillar, 3M, United Technologies, IBM, etc. Imagine how the stock market will react when they see miserable earnings from such bulwark companies. How many people will buy Apple phones? How many small businesses will be installing new computer systems? What about makers of restaurant equipment - Hobart mixers, commercial ovens and dishwashers? I believe that the many pundits who say that "the worst is over" in the stock market are kidding themselves. The market is already pricing in a somewhat slow recovery from the pandemic. Equity markets have rallied recently, driven by liquidity from global stimulus; however, earnings expectations for companies are dropping rapidly. Poor earnings may further frighten investors and cause another stock market decline.

• The hospitality and travel industries will be decimated. Airlines will take years to recover - there's a reason Warren Buffett sold all his airline stocks. At this writing, passenger traffic is down about 94% and half of the industry's 6,215 planes are parked at major airports and desert airstrips, according to Airlines for America, a trade group. Six-across, no knee-room sardine-style seating is probably dead as well - aircraft will need to be remodeled and reconfigured. Ticket prices will probably soar and traffic will fall. I believe that it will take several years for airline travel to get back to 2019 levels.

• The hospitality and travel industries will be decimated. Airlines will take years to recover - there's a reason Warren Buffett sold all his airline stocks. At this writing, passenger traffic is down about 94% and half of the industry's 6,215 planes are parked at major airports and desert airstrips, according to Airlines for America, a trade group. Six-across, no knee-room sardine-style seating is probably dead as well - aircraft will need to be remodeled and reconfigured. Ticket prices will probably soar and traffic will fall. I believe that it will take several years for airline travel to get back to 2019 levels.

Already in trouble because of its flawed 737 Max aircraft, Boeing may go belly-up due to lack of orders. Will the government bail them out because of national security issues? Difficult to say.

Most hotels/motels require a 60+% occupancy rate to survive. For the near term, there are too many hotel rooms and too few travelers. I would expect to see a lot of hotel bankruptcies. And those billion dollar mega-behemoth cruise ships are probably dead as dinosaurs. The rental car business has been hurting; Hertz filed for bankruptcy last week.

• Mass transit will get some of its riders back in the post-pandemic world, but not all of them. Mass transit expert Randall O'Toole wrote, "Transit in a post-pandemic world is likely to carry at least 25% fewer riders than it did before the pandemic."

• The development of fully-autonomous vehicles will be delayed. Covid-19 has thrown a monkey wrench into this business plan. Taxi and ride-hailing drivers can sanitize their cars after each use. They can even do the sanitizing in front of squeamish customers to ensure that they are comfortable riding their cars. But a driverless car by definition has no one to do such sanitizing.

• The flight from cities will continue and pick up pace, as people seek "space" and lower taxes. A recent Harris poll found that 27% of Americans, including 39% of city residents, are considering moving to less-dense areas because of the coronavirus. Younger people who are supposedly most attracted to the cities are the ones most likely to want to move, and some already have. Working from home will trend higher; technology makes it not only possible but for many - seamless. Global Workplace Analytics, an organization that focuses on "the future of work," estimates that 56% of American workers could work at home at least part of the time. The firm predicts that, after the pandemic, 25 to 30% will work at home multiple days of the week.

• There will be great shifts in international trade. China will be the loser. U.S. companies were beginning to leave China because of the trade war. They'll leave even faster thanks to the Wuhan virus. The main beneficiaries of this will be the smaller southeast Asian nations, led by Vietnam and Thailand. Thanks to the passing of the U.S.-Mexico-Canada Agreement, Mexico is becoming a new favorite spot for sourcing. China is currently the go-to source for ibuprofen, hazmat suits, rubber gloves, surgical masks, ventilators. This will change. Some drug manufacturing will move back to the U.S., some will go to India.

• There will be great shifts in international trade. China will be the loser. U.S. companies were beginning to leave China because of the trade war. They'll leave even faster thanks to the Wuhan virus. The main beneficiaries of this will be the smaller southeast Asian nations, led by Vietnam and Thailand. Thanks to the passing of the U.S.-Mexico-Canada Agreement, Mexico is becoming a new favorite spot for sourcing. China is currently the go-to source for ibuprofen, hazmat suits, rubber gloves, surgical masks, ventilators. This will change. Some drug manufacturing will move back to the U.S., some will go to India.

Our position with other trading nations will survive and prosper, because they're angry with China, too. Worldwide, there are over 5 million covid-19 cases and over 300,000 deaths. All economies have been devastated like ours and our position vis-à-vis other nations is relatively good. The dollar remains strong against other currencies and we have not needed to resort to negative interest rates.

James Lileks recently wrote, "Wuhan Virus - I call it that because they were probably tinkering on a virus to learn things, and crap crap, that shouldn't have happened, well, hope for the best."

It is not settled whether the Wuhan coronavirus was caused by stupidity or something more sinister. (An Australian scientific study concluded that the coronavirus causing the global pandemic contains unique properties suggesting it was manipulated in a Chinese laboratory and was not the result of a natural occurrence.) In any case, the fact that China withheld vital facts and data caused the deaths of many worldwide. The blood is on their hands and, for a regime of alleged long-term thinkers they have certainly shot themselves in the foot in a way that will have long-term consequences.

All of us hope that we get through this and return to past greatness due to our American spirit and drive. When the history of the Wuhan Epidemic is written ten or twenty years from now, I hope that it is written in Americanized English, not Mandarin. (posted 5/26/20, permalink)

Who's Gonna Lose The Most? The China coronavirus has decimated American business. Don Surber wrote, "Gradually it is dawning on people that the big losers in covid-19 are fracking, airlines, hotels, restaurants, newspapers, and New York City. The first three are resilient because they have weathered many a business cycle but he latter three are devastated.

One industry in peril that does not get mentioned is the automotive industry, particularly those who service vehicles."

One industry in peril that does not get mentioned is the automotive industry, particularly those who service vehicles."

The entire auto industry will be affected. Don noted, "Automobiles are sturdier and last longer. My car is 10 years old and I see no reason for it not to go another 10 years, especially as I have averaged less than 10,000 miles annually in the last 6 years.

Projecting my experience on those working from home, I see fewer oil changes, fewer tire purchases, and fewer automobile repairs.

I also see fewer car companies. The American market is stagnated."

Then there's the Big Apple, which is going to get a lot of bites taken out of it. "The financial center of America is now the epicenter of covid-19 of America. Wall Street is now telecommuting. Is there any reason to stop once the all-clear signal sounds?

The trillions of dollars invested in stocks and bonds can be bought and sold online. Why bother having a presence in Manhattan where the rents are high? Brokers are still needed, but they can relocate to less congested places that are less susceptible to Chinese viruses. Other corporate headquarters also will re-locate. Why would a CEO risk his health to live there? … The rest of the service industry also will suffer. Fewer offices means fewer maintenance crews. It also means fewer packages sent by FedEx and the like. The people who make the city run face layoffs."

"Then there is Times Square and tourism. Visit New York City? Are you crazy? Why would anyone from Twin Oaks, Ohio, want to risk getting the next covid-19 there? This is not 9/11 where everyone rallied behind New York. Rudy Giuliani is not the mayor now, some communist named de Blasio is. New York was a victim in 2001. Now many Americans blame New York City for this shutdown." That may be harsh because the Chinese deserve our wrath and blame, even if Bill de Blasio is a hapless jerk.

Then there are newspapers. "Covid-19 hastens the newspaper industry's demise. Local ads are all they have left and most local businesses are closed. The local newspaper's free shoppers was reduced to one piece of paper. There was a page one and flip it over it was page two. Four press releases a recipe, crossword puzzle, Soduku, and three tiny ads. The inserts may have covered the cost of mailing." Over 2,000 newspapers have closed in the last 15 years. Last year, newspaper circulation was at the lowest level since 1940. And it continues to spiral downward.

Then there are newspapers. "Covid-19 hastens the newspaper industry's demise. Local ads are all they have left and most local businesses are closed. The local newspaper's free shoppers was reduced to one piece of paper. There was a page one and flip it over it was page two. Four press releases a recipe, crossword puzzle, Soduku, and three tiny ads. The inserts may have covered the cost of mailing." Over 2,000 newspapers have closed in the last 15 years. Last year, newspaper circulation was at the lowest level since 1940. And it continues to spiral downward.

Local newspapers are slashing staff and publishing less frequently as the already-battered businesses try to weather the covid-19 storm. Many either won't survive or will have to drastically reduce their operations. The ads are going, going, gone. As Tyler Durden at ZeroHedge wrote, "Traditional print media was already on the ropes long before the crisis, in competition with exploding alternative forms of digital news and independent platforms, but the corona virus pandemic and accompanying shutdown of the economy could prove the final death blow."

Dean Ridings, chief executive officer of America's Newspapers, a national trade association, told Bloomberg News, "I'm hearing 40% to 60% drops in revenue over the last 30 days. The advertisers are the local mom and pops, the retailers, the restaurants, who are understandably canceling their advertisements." Suber added, "Newspaper efforts to go online has largely been dinosaurs trying to do ballet. Paywalls? Really? They want people to rent their cows when milk is free? Old bad habits die hard." (posted 5/20/20, permalink)

Bad Prediction: Back in 2007, CNBC stock market tout Jim Cramer proclaimed that Sears Holdings "could be the next Berkshire Hathaway," noting that CEO and chief stockholder, Eddie Lampert "is a terrific investor and he's the brains behind Sears."

Bad Prediction: Back in 2007, CNBC stock market tout Jim Cramer proclaimed that Sears Holdings "could be the next Berkshire Hathaway," noting that CEO and chief stockholder, Eddie Lampert "is a terrific investor and he's the brains behind Sears."

Sears Holdings filed for bankruptcy Monday, amid plunging sales and massive debt, culminating in the collapse of what was once America's largest retailer. Last Thursday, the stock share price was down to 38¢.

In 2009, I suggested this foolproof plan to make money in the stock market: Do the opposite of whatever Cramer recommends.

James Lileks wrote that nobody cares about Sears anymore. He noted that the last time he set foot in a Sears was "on pre-Black Friday, and it was hilarious: they had nothing. The biggest shopping day of the year, and the store was a dumpy jumble. No one thinks about Sears for anything. It's the store you walk through to get to the rest of the mall."

If Sears shuts down (after 125 years in business), 90,000 employees will lose their jobs. It is hard to remember any event that put so many people out of work.

Such a deal would allow Sears to keep open some of its roughly 900 stores for at least a little bit longer. Sears will aim to stay in operation through the holidays, during which it will seek a buyer. Who would want it? Sears last profitable year was 2010. The company rang up less than $17 billion in sales in fiscal 2017, half of the roughly $40 billion in revenue it brought in five years earlier. As part of the bankruptcy plan, Sears will immediately close roughly 150 of its 700 remaining stores.

Once upon a time, there was a Sears catalog in almost every American home. My parents and grandparents used to shop at Sears. In the 1980s, we were big Sears customers, probably spending $15,000 per year. In late 1989, Sears changed their policies and began charging money for catalogs. That was the end of our relationship with Sears. (posted 10/16/18, permalink)

Things Are Looking Up - Big Time: Scott Grannis recently wrote, "Something has been holding back the economy, and it might be as simple as a general unwillingness on the part of business to expand and invest in new plant and equipment. Confidence is key, and confidence has, until fairly recently, been low." Thanks for nuttin', Obama.

President Trump changed all that. Looking at the chart above, it can be seen that Small Business Optimism has reached highs not seen since 1983-84. That was during the Reagan Recovery Years, which I remember very well. In 1983, my plastics manufacturing company's annual sales increased a whopping 89% over the prior year. In 1984, sales continued to soar, increasing by 62%.

When did Optimism begin to soar again? Right after Donald Trump's election.

Scott noted that "a pronounced and sustained increase in small business optimism and hiring intentions - an increase that dates to December 2016, just days after Trump was elected. Small businesses generate the vast majority of new jobs, and they are a vital source of innovation and productivity. These charts argue convincingly for a stronger economy in the months and years to come, thanks to increased business optimism and investment."

Donald Trump really is making America great again. (posted 8/22/18, permalink)

Cubist Wisdom: Recently, Peter De Lorenzo of AutoExtremist wrote about Ford Motor Company's decision to cut most of its passenger car lineup, deleting the Fiesta, Fusion, and Taurus in favor of building more crossovers and SUVs. He remarked, "Why this news seemed to capture the media's fancy seemed a little odd to me, considering the fact that this was an American automobile company being proactive while anticipating and positioning itself to take advantage of market conditions that were destined not to change anytime soon. And I am quite sure if this was an imported car company declaring this step, the hand-wringing would be negligible to nonexistent. But then again this is Ford, and the mainstream media feels it is eminently qualified to weigh in on the matter, even if too many of its members are not."

Cubist Wisdom: Recently, Peter De Lorenzo of AutoExtremist wrote about Ford Motor Company's decision to cut most of its passenger car lineup, deleting the Fiesta, Fusion, and Taurus in favor of building more crossovers and SUVs. He remarked, "Why this news seemed to capture the media's fancy seemed a little odd to me, considering the fact that this was an American automobile company being proactive while anticipating and positioning itself to take advantage of market conditions that were destined not to change anytime soon. And I am quite sure if this was an imported car company declaring this step, the hand-wringing would be negligible to nonexistent. But then again this is Ford, and the mainstream media feels it is eminently qualified to weigh in on the matter, even if too many of its members are not."

It is difficult to argue with Ford's reasoning. Over 40 years ago, Henry Ford II grumbled, "Small cars mean small profits." Ford has never made much money on its small sedans because the market segment is so competitive. Given the proliferation of mid-size sedan offerings over the last 30 years, the mid-size market segment has also become ultra-competitive, resulting in minimal profits. Now that the market for sedans of all sizes is shrinking (due to the popularity of SUVs), declining volume means fewer sedans to carry fixed overhead translating to a money-losing segment for Ford and those other automakers who were never geared-up to compete with more efficient firms such as Toyota, Honda, Subaru, Hyundai and Kia.

When my plastics manufacturing company first entered the clear acrylic display market, we were confronted with product prices already established by multiple competitors. Our brilliant SCORE/SBA consultant, Bernard Guthrie, had drummed this mantra into our heads: If you make a profit on every thing you do, your company will make a profit each and every month.

|

|

|

Sampling of transparent display products - clear acrylic cubes shown at left

|

Mr. Guthrie's advice worked month after month. We were dismayed to discover that, in the arena of 5-sided clear acrylic display cubes, some sizes were market-priced far below our cost. Any display cube from 4 inches to 8 inches in size has almost identical manufacturing costs but the price of an 8-inch cube was more than double that of a 4-inch cube. The price of a 4-inch was far too low to be profitable, a 6-inch cube was priced at our break-even cost. We made a decent profit on 8-inch cubes and anything larger was very profitable. So, what did we do? First, we elected not offer a 4-inch model. Our 6-inch cube was priced 10% higher than our main competitor. Our 8-inch cube was priced identically to the competition. All larger sizes were priced a little lower than those of other acrylic display fabricators.

Our customers never squawked about the lack of a 4-inch model in our line. And, since they usually bought a variety of sizes with each order, they still purchased our 6-inch offerings. Our display cube segment made a good profit month in and month out.

Ford has the option of continuing to sell high-profit sedans if the volume warrants - the fate of the Lincoln Continental will be determined by its sales. It is priced to make a good profit as long as the volume is sufficient to cover fixed costs.

Ford is running its business like a business. I wouldn't be surprised if GM and Fiat-Chrysler soon exit the low-volume, low-margin sedan business as well. (posted 6/11/18, permalink)

Brando Is Dead And Harley-Davidson Ain't Feeling To Well, Either: The 1950s movie 'The Wild One' made Marlon Brando a star and fueled young men's passions for noisy, outlaw-image Harley-Davidson motorcycles.

Brando Is Dead And Harley-Davidson Ain't Feeling To Well, Either: The 1950s movie 'The Wild One' made Marlon Brando a star and fueled young men's passions for noisy, outlaw-image Harley-Davidson motorcycles.

Marlon is gone, most of the teens from 1953 are now cruisin' in Rascals and Harley-Davidson is sinking. I mean, how many gray-haired, aging men with ponytails are there, anyway?

"After years of often aggressive growth, demand for its classic, heavy, noisy American motorcycles has taken a sharp tumble and the Milwaukee-based manufacturer says it will have shutter an assembly plant in Kansas City, Missouri. The biggest hit has come from the U.S. market where aging Baby Boomers had been driving a Harley resurgence during the last two decades. Stateside demand was off 8.5% last year, while international sales fell a slightly more modest 3.9%."

Harley now plans to offer a battery-based bike - good luck with that.

"U.S. demand for motorcycles took a massive hit during the Great Recession and barely recovered even as the economy started to mend. From peak sales of around 900,000 vehicles in 2006, demand slid to barely 350,000 in 2010, the same year auto sales cratered. But in 2016 – the last year for which total industry numbers are available, sales of on- and off-road bikes came to just 371,403."

Many Boomers are hanging up their leathers for good, and they aren't being replaced in the saddle by millennials and Gen-Xers.

On the other hand, what do I know? I've never been on a Hog and I'm not much of a motorcycle guy anyway. The last time I rode one many years ago, I was a twenty-something taking a spin on my friend Ray Lukas' wickedly fast and scary Royal Enfield Interceptor, a tall, 736 cc monster. I was storing the big bike in my garage while Ray was serving in Vietnam. (posted 2/23/18, permalink)

Fewer Toys; Higher Prices: Maz Woolley of Model Auto Review recently attended a commercial toy fair in Europe and concluded that "the area devoted to model vehicles gets smaller each year. Many manufacturers or agents cannot afford to exhibit, so they invite buyers to see them at other sites outside the halls whilst the fair is on. The large number of companies selling model vehicles gives the impression of a growing and thriving industry, but the days when Corgi and Dinky sold millions of a single casting are long gone, and even large industrial firms can now only sell individual models in thousands, whilst specialist firms produce batches of fewer than a hundred models.

Fewer Toys; Higher Prices: Maz Woolley of Model Auto Review recently attended a commercial toy fair in Europe and concluded that "the area devoted to model vehicles gets smaller each year. Many manufacturers or agents cannot afford to exhibit, so they invite buyers to see them at other sites outside the halls whilst the fair is on. The large number of companies selling model vehicles gives the impression of a growing and thriving industry, but the days when Corgi and Dinky sold millions of a single casting are long gone, and even large industrial firms can now only sell individual models in thousands, whilst specialist firms produce batches of fewer than a hundred models.

So the industry is making the most of a declining customer base, that has accepted some significant price rises in the last year. But this situation is not sustainable in the long term, unless new buyers, especially younger people, begin to collect. But there seems to be little evidence that they are doing so in significant numbers."

Over the past several years, I've noticed a decline in 1:43 scale offerings especially in the moderately-priced diecast segment. There are pricey $90-$120 resin models from China and even more-expensive white-metal Brooklin models (hand-cast in Bath, England), offering less detail and now costing $160-$350. Most model collectors are unwilling to pay that kind of money for a 4 to 5-inch long model.

Interestingly, internet retailer Diecast Direct just ran a big sale on older collectible Brooklin editions, with prices as low as $24.99. A rare cream-colored 1940 Ford panel delivery from 1988, imprinted with '400th Anniversary Spanish Armada' (only 150 examples were produced in this livery) was offered for $27.99. A 1940 red Cadillac V16 convertible, one of 400 made especially for the Canadian Toy Collectors Society - a model which fetched prices of $349 in the late 1990s, was on sale for a mere $64.99. Collector model car prices are falling off a cliff.

As someone who used to buy up to 100 model cars per year, I haven't made any new purchases in the last 12 months. I've yet to find something worth the asking price.

The collapsing market for traditional toy, hobby and collectible items shows no sign of abating. Toy giant Mattel's holiday fourth-quarter financial results revealed "a net loss of $281.3 million and $1.61 billion in revenue." While sales of Barbie dolls and related products were up 9%, sales of American Girl branded merchandise fell 23%. Gross sales for Fischer-Price were down 12% as reported, and down 14%, primarily driven by declines in infant and preschool products and Thomas & Friends. Worldwide gross sales for Construction and Arts & Crafts were off 25% as reported, primarily driven by declines in MEGA BLOKS licensed and preschool products. Hot Wheels - once a billion dollar brand - and Matchbox weren't even mentioned.

Mattel has faced slowing sales in a number of its brands in the last few years as more children gravitate toward video games and electronics instead of traditional toys. (posted 2/19/18, permalink)

Trouble In Toyland: Hornby Hobbies is a UK-based toy and model conglomerate. The original company was founded by Frank Hornby in 1901 and focused on toy trains. Today, the firm owns a number of model trains and railroad accessory brands (Hornby, Lima, Jouef, Arnold, Rivarossi, Lyddie End Scaledale), model and toy vehicles (Corgi, Scalextric, Pocher), as well as model aircraft and accessories (Airfix, Corgi, Humbrol).

Trouble In Toyland: Hornby Hobbies is a UK-based toy and model conglomerate. The original company was founded by Frank Hornby in 1901 and focused on toy trains. Today, the firm owns a number of model trains and railroad accessory brands (Hornby, Lima, Jouef, Arnold, Rivarossi, Lyddie End Scaledale), model and toy vehicles (Corgi, Scalextric, Pocher), as well as model aircraft and accessories (Airfix, Corgi, Humbrol).

In 2015, Hornby began a series of declining financial results. The major reason behind the decline, Hornby declared was two-fold: the decline in the number of collectable customers (due to old age or death), and a lack of interest in modeling as a hobby in light of internet activities. After the stock price dropped by more than 50% in a year, Hornby declared that it planned to cut more than half of the toys it made, after discovering that it generated 90% of its profits from only 50% of its range. I'm shocked that it took Hornby management so many years to figure this out but I wouldn't be surprised if - based on the venerable 80/20 rule - that 80% of their profits came from 20% of their offerings. This means that Hornby Hobbies would have to raise all prices by more than 25% just to break-even.

Maz Wooley of Model Auto Review noted that the company recently reorganized with new management, In the last 6 months, revenue fell from $29.2 million to $22.7 million year-over-year - a drop of over 22%. Furthermore, the company's losses now total over 20% of net sales - a very ... (more >>>)

Amazon Nation: Does it sometimes feel to you like Amazon is taking over the world? Me too. Karl Denninger thinks so too, although he - like me - wonders how they make any money. Karl noted that "Amazon is turning nearly a negative 20% margin on goods sold not including SG&A (that is, their sales and administrative expenses, such as the buildings and their employees) but only counting the cost of goods sold and their fulfillment (shipping and warehousing) expense."

In the third quarter, Amazon's fulfillment costs (pick, pack and load orders) was over 22% of sales. I'm shocked at this because, in my plastics display business, much of which was a pick, pack and load operation, our fulfillment costs were in the 10-12% range and we didn't have the robots and other 21st Century automation that Amazon employs. We also only shipped 250-350 boxes per day.

In the 1970s, the Plastics Department of Rohm & Haas Co., my then-employer, reported PLS (pack, load and ship) costs of 3% of net sales. Of course, R&H sold mostly in bulk.

An article by Michael J. Coren in Quartz noted, "Amazon today is a retailer, a logistics network, a book publisher, a movie studio, a fashion designer, a hardware maker, a cloud services provider, and far, far more. The private equity firm Pitchbook estimates the company Jeff Bezos founded in 1994 competes head-to-head with at least 129 major corporations just in major markets. That number grows higher as it adds new business units such as fashion, food, and analytics.

Amazon's strategy drives down prices by leveraging a direct relationship between customers and its massive e-commerce and logistics operations. This "flywheel" attracts even more loyal customers who return for the convenience and low prices. Amazon's scale means it can cross-subsidize huge losses from different ventures, plowing profits back into businesses that work. The aim is not to make money on any particular service; Amazon likely lost $7.2 billion on shipping last year and is selling hardware supporting its virtual assistant Alexa around or below cost. It's adding to the value of the system itself. Entire industries are loss leaders for Amazon. For companies that must make money on what they sell, it's a terrifying prospect."

Amazon makes almost nothing on sales of its products and services except media and cloud storage, a soon-to-be commodity market. Basically, they sell things like electronics at break-even.

Coren concluded that "Amazon sports a sky-high valuation because investors are banking that every customer gained today will pay off handsomely in the future." Good luck with that.

Like the discount stores of the 1950s and '60s, (E.J. Corvette, Two Guys, S. Klein, etc.), margins and profits have always been low to nonexistent. And you know what happened to those guys. My advise: Buy 'stuff' from Amazon if you want but don't buy the stock, which trades at over $1,100 per share and has a P/E ratio of close to 300/1. (posted 11/13/17, permalink)

Bursting Bubble Ahead? In six years, vehicle loans have increased more than 55%.

32.5% of all subprime auto loans are now categorized as "deep subprime," with FICO scores below 550. In 2010, the percentage was just 5.1%. With the recent decline in new car sales, banks are tightening their lending standards for auto loans.

"While consumers have fallen behind on most subprime auto loans, the deep classification is responsible for the most serious cases of nonpayment. Delinquencies surpassing 60-day periods have tripled since 2012 and indicate little sign of stabilizing." Last year, financial analyst Malcolm Berko noted that 1 in 3 vehicles traded in for a new car have a negative equity.

It's a race to see which bubble will burst first: student loan debt or subprime auto loans. (posted 5/17/17, permalink)

Richer Than Ever: Scott Grannis recently wrote that "our net worth reached a new high in nominal, real, and per capita terms. We have been struggling through the weakest recovery ever, but at the same time we are better off than ever before, and by a lot." America's light continues to shine brightly - capitalism works.

Richer Than Ever: Scott Grannis recently wrote that "our net worth reached a new high in nominal, real, and per capita terms. We have been struggling through the weakest recovery ever, but at the same time we are better off than ever before, and by a lot." America's light continues to shine brightly - capitalism works.

"On a real per capita basis (i.e., after adjusting for inflation and population growth), the net worth of the average person living in the U.S. has reached a new all-time high of $286K, up from $62K in 1950. This measure of wealth has been rising, on average, about 2.3% per year since records were first kept beginning in 1951. By this metric, life in the U.S. has been getting better and better for generations." Yes, there are blips - upward and downward deviations from the norm - but the basic upward trend has a 66-year track record.

"The ongoing accumulation of wealth is not a house of cards built on a bulging debt bubble either, regardless of what you might hear from the scaremongers ... the typical household has cut its leverage by one third, from a high of 22.1% in early 2009 to 14.8% by the end of last year. Households have been prudently and impressively strengthening their balance sheets over the past seven years by saving and investing more and by reducing the use of debt financing." Because the safety net of a guaranteed retirement payout has largely disappeared from the U.S. private sector landscape, replaced by self-directed 401(k) plans, IRAs and the like and because the post WWII corporate womb-to-tomb security has evaporated, people have been forced to be responsible caretakers of their own monetary destiny.

Despite so many apocryphal tales of clueless, overextended spendthrifts, the data tell a different story. Pay no attention to downbeat books such as Edward McClelland's 'Nothin' But Blue Skies: The Heyday, Hard Times, and Hopes of America's Industrial Heartland'. As a group, U.S. consumers generally act rationally and do a decent job managing their financial resources.

Scott concluded, "Is this a great country or what?" (posted 3/24/17, permalink)

Numbers Don't Lie: Based on average annual GDP growth, Barack Obama is the worst president ever as The Simpsons' Comic Book Guy would say.

According to Mark Perry, Gross Domestic Product grew slowest under President Obama compared with his 10 presidential predecessors:

|

U.S.

President

|

Avg. Annual

GDP Growth

|

|

U.S.

President

|

Avg. Annual

GDP Growth

|

| Lyndon B. Johnson |

5.29%

|

|

Dwight Eisenhower |

3.00%

|

| John F. Kennedy |

4.33%

|

|

Richard M. Nixon |

2.81%

|

| Bill Clinton |

3.87%

|

|

Gerald Ford |

2.56%

|

| Ronald Reagan |

3.47%

|

|

George H.W. Bush |

2.26%

|

| Jimmy Carter |

3.25%

|

|

George W. Bush |

2.10%

|

|

|

|

Barack Obama |

1.46%

|

Dr. Perry wrote, "Obama was also the only president in this group that didn't have a single year of 3% economic growth during his time in office." These data came from the Bureau of Economic Analysis. (posted 2/22/17, permalink)

Slick Situation: Shawn Driscoll, manager of the T. Rowe Price New Era Fund, wrote that oil will average $40-50 per barrel over the next decade. "Fast-forward to about 2006 when the shale era of horizontal drilling and hydraulic fracturing really got underway. Since then, productivity - measured by gross barrels produced per rig - has improved at an exceptional rate. New shale formations, such as those in North Dakota, Texas, and New Mexico, now account for a significant amount of incremental global supply annually."

In fact, the United States now rivals Saudi Arabia and Russia as a leader in total global oil production. "While the Organization of Petroleum Exporting Countries (OPEC) accounts for about 40% of total global oil production, the United States has provided more than 50% of the incremental gains in the global oil supply since 2008." (posted 12/14/16, permalink)

Slow Going: Scott Grannis has posted a graph showing the growth of the Gross Domestic Product over the past 50 years:

He wrote, "The chart above illustrates just how miserable economic growth has been in the current recovery. Instead of averaging just over 3% growth per year, as it did from 1965 though 2007, the economy has only managed a 2.1% annualized pace for the past seven and a quarter years. The gap between where we are and where we might have been had this been a normal recovery is a bit more than $3 trillion, by my calculations. That's huge, and that's the measure of our discontent."

The last time that the GDP fell behind was at the end of the Jimmy Carter years. I remember that era well. Business conditions were abominable. Linn County Oregon had a 27% unemployment rate; the national rate was more than double what it is today. The Dow was at 800 or so. Mortgage rates on conventional 30-year loans topped out at 18.63%.

As a nation, we learned that you can't combine big wars and big social programs - you must pick one. If you insist on choosing both, you will pay dearly in less than 10 years. We observed the results of the excesses of the 1960s when Lyndon Johnson's failed and expensive Great Society program was launched just as the cost of the Vietnam War was escalating. The result was the Misery Index (the sum of inflation rate and unemployment rate) of the late 1970s - a number resulting from high inflation combined with a stagnant, high-unemployment economy.

Blame it on both Republican and Democratic administrations from 1965 through 1980. During Jimmy Carter's term, inflation reached 13.3%. By mid-1980, the prime rate was over 20%. Unsecured personal loans were actually cheaper at Household Finance Corporation than small business loans were at my local banks in those days.

I remember coming home from work exhausted after a 10-plus-hour, hot-as-hell, July 1979 day at my then-struggling manufacturing business, arriving just in time for the 6:00 pm Pacific time Oval Office lecture from a stern-faced Jimmy Carter - the one where he told us that everything was our fault because we had a Bad Attitude. At that moment, I became a Republican. And Ronald Reagan subsequently got my vote.

As President, Ronald Reagan and his staff moved quickly to fix America's mess. His initial moves threw this country into a steep recession (probably overdue anyway), but we recovered in the typical 18 months. By that time, inflation rates had fallen - and stayed down. During Reagan's 8 years the inflation averaged less than 4%. The Misery Index disappeared from the nation's vocabulary.

The stock market took off in a recovery which continued (with the occasional hiccup) for the remainder of the 20th Century. Unemployment subsided, too. Recessions since then have been normal in scope but infrequent in nature. The dollar recovered - so much that, by the mid-1980s, the British pound was down to $1.09. And 'stagflation' disappeared from America's lexicon.

In the first part of the 21st Century, we - once again - combined big wars (this time in the Middle East) and expanded social programs (nonexistant immigration control / welfare programs for illegals, the Medicare/Medicaid drug program and loosened requirements for disability claims) - and we paid for it with slow growth after the Great Recession of '08. Once again, there's much blame to go around in both political parties.

Ronald Reagan made America great again. Let's hope that Donald Trump can do the same. (posted 12/8/16, permalink)

Rotten Tomatoes & Rotten Economy: Garden Fresh Restaurant Corp., owner of the Sweet Tomatoes and Souplantations restaurant chains, has filed for Chapter 11 bankruptcy protection. The company owns over 100 restaurants and could close up to 30 locations. Garden Fresh owes nearly $175 million to lender groups. The Sweet Tomatoes in Vancouver, Washington, which offers mostly salads and soups, plans to remain open.

The restaurant industry is in trouble, these days. "Revenues and same-store sales have been declining for most of 2016," said Kurt Schnaubelt, of restructuring firm AlixPartners, about the restaurant industry.

The general business climate continues to be lousy. According to the American Bankruptcy Association, commercial bankruptcy filings are higher by 28% through the first nine months of the year to 28,789.

Business closures now exceed business formations. The rate at which new companies are being formed has fallen steadily for over three decades - almost 30%. By other measures - as a share of all businesses or relative to the size of the working-age population - it has fallen in half. This is a major problem, since the vast majority of new U.S. private-sector jobs (65%-90%, depending upon which data source you choose) are created by small businesses.

This decline has occurred nationwide - even in tech-heavy, entrepreneurial Silicon Valley. Business creation there is still higher than the rest of the country, but it's down markedly from the past, according to the Brookings Institution.

Finally, 94,184,000 Americans were not in the labor force in September - the largest number since the Misery Index era of the Carter administration in 1977. Thanks, Obama. (posted 10/10/16, permalink)

The Wealth Of The Nation: Scott Grannis wrote, "On a real, per capita basis, the net worth of the average person living in the U.S. reached a new all-time high of $273,560. This measure of wealth has been rising, on average, about 2.4% per year since records were first kept beginning in 1951." This graph illustrates the point:

"The ongoing accumulation of wealth is not a house of cards built on a bulging debt bubble either, regardless of what you might hear from the scaremongers. The typical household has cut its leverage by over 30% (from 22% to 15%) since the onset of the Great Recession in 2008. Household liabilities today are the same as they were in early 2008 (about $14.5 trillion), but financial assets have increased by one-third since then, thanks to significant gains in savings deposits, bonds, and equities."

Pay no attention to those Feel The Bern progressive crowd who claim that the rich are getting richer and the poor are getting poorer. "Income inequality is not a factor either in the ongoing rise in wealth ... the share of total income earned by the top 5% and top 20% of households has been essentially unchanged for many years."

Nevertheless, I still feel that the savings rate for most Americans is too far low - resulting in that low net worth gain of only 2.4% per year. It needs to grow much faster for those who want a comfortable retirement. During my peak earning years (age 40 to 55), we saved like crazy and our net worth grew thirteen-fold. Even in retirement, with no working income (just money from Social Security, stock dividends and, more recently, mandatory IRA withdrawals), our net worth is still growing at an inflation-adjusted rate of over 6%/year.

How do I know that the savings rate is too low? Consider this: Nearly half of those earning between $100,000 to $149,999 a year have less than $1,000 in a savings account. And almost 29% of those earning more than $150,000 have less than $1,000 in their savings account. (posted 7/5/16, permalink)

Why So Many People Feel Poor These Days: Breitbart News noted, "The number of Americans not in the workforce during the month of April (2016) increased substantially compared to the previous month - again tipping over the 94 million mark - according to Labor Department data. The Bureau of Labor Statistics reported that 94,044,000 Americans were neither employed nor made an effort to find employment - due to discouragement, retirement, schooling or otherwise - in April. Last month's numbers represented an increase of 562,000 over the month of March, when 93,482,000 Americans were out of the workforce."

Why So Many People Feel Poor These Days: Breitbart News noted, "The number of Americans not in the workforce during the month of April (2016) increased substantially compared to the previous month - again tipping over the 94 million mark - according to Labor Department data. The Bureau of Labor Statistics reported that 94,044,000 Americans were neither employed nor made an effort to find employment - due to discouragement, retirement, schooling or otherwise - in April. Last month's numbers represented an increase of 562,000 over the month of March, when 93,482,000 Americans were out of the workforce."

In total 151,320,000 Americans had a job last month and another 7,920,000 Americans were unemployed. 2.1 million workers have been out of work for at least 27 weeks. 568,000 discouraged workers stopped looking for jobs in April.

"The U.S. economy added the fewest number of jobs in seven months in April and Americans dropped out of the labor force, signs of weakness that left some economists anticipating only one interest rate hike from the Federal Reserve this year." April job cuts exceeded 65,000 workers, up 35% from March and a seven-year high.

In the last 18 months, the mining industry has lost 191,000 jobs due to onerous clean fuel regulations promulgated by the Obama Administration. Government regulations imposed by agencies - rather than Congress - cost businesses $1.9 trillion last year."

Industries that showed strong first-quarter job growth have now pulled back, with retailers cutting payrolls by the most in two years and construction companies adding the fewest positions since June. More tempered additions to headcounts shows hiring managers are adjusting in the wake of economic growth that has slowed for three straight quarters. One also has to look at the kind of jobs being created. They haven't been all that great, and wage stagnation has been the rule, rather than the exception.

For the first time since the Great Depression, Americans are losing ground that they cannot seem to regain. Median household income fell by nearly 10% from 1999 through 2011 and remains far below previous peaks. The rate of participation in the labor force has fallen from 66% before the 2008 financial crisis to just 62%, the lowest since the 1970s. A generation of young people has graduated from college to face mediocre earnings prospects and mountains of student debt.

For those unfortunate retirees who depend on income from fixed-rate investments such as money market funds and CDs, they have suffered greatly under Barack Obama's seven-plus years of leadership. Courtesy of Lipper, here are the returns on the average money market fund for the past 10 years:

|

Year

|

MM

return

|

|

Year

|

MM

return

|

| 2006 |

3.69%

|

|

2011 |

0.00%

|

| 2007 |

4.65%

|

|

2012 |

0.00%

|

| 2008 |

3.02%

|

|

2013 |

0.00%

|

| 2009 |

0.62%

|

|

2014 |

0.00%

|

| 2010 |

0.02%

|

|

2015 |

0.00%

|

So far in 2016, the average money market fund total return remains at zero.

Thanks for nothing (literally!!!), Obama. In this election year, let's vote for you-know-who and Make America Great Again. (posted 5/23/16, permalink)

Implied Promises Not Kept: Politicians of yore promised us the modern version of A Chicken In Every Pot ... work hard and you'll get womb-to-tomb security.

Blue-collar and mid-management white collar voters now feel betrayed. Their jobs have disappeared because of 1. automation, 2. computers, 3. the internet and 4. free trade.

Said one worker, who was employed by a hospital furnishings manufacturer for almost 43 years until his job was outsourced to China, "You had the job, you figured you were planning out how things were going to go. Now you've got to back up and rethink."

Said one worker, who was employed by a hospital furnishings manufacturer for almost 43 years until his job was outsourced to China, "You had the job, you figured you were planning out how things were going to go. Now you've got to back up and rethink."

The manufacturer "shuttered its plant in Stevens Point, WI in 2012 after years of gradually outsourcing work to China. It cut loose 175 workers." Milwaukee, once known as "the machine shop to the world," is now grappling with a new economy. So are most other areas where 50 and 60-somethings have found their 'careers' disappearing. They are now looking for work and finding none. Or poorer-paying jobs with little or no security.

Many of those who have not experienced offshoring end up as freelancers with no benefits or job security. Popular alternative euphemisms include 'contingent worker' and 'temp independent consultant'. This is the new workplace world and it means that many well-educated, middle-class folks are now finding themselves 'underemployed', with reduced hours and little if any job security. Much like ditch diggers in 1913.

A worker at Caterpillar - a company which has laid off about 600 of its 800-plus workers over the past two years because of a business slowdown - said, "It's had a pretty large impact. Whether it's small grocery stores, a hardware store down the street or local taverns - they used to get a lot of business from the people that live in this community who were making a good living, a good wage working here." No longer - kinda the evil-twin of a trickle-down economy.

The turmoil feeds into a debate over trade that's playing out in the 2016 campaign. Donald Trump and Bernie Sanders have been the most outspoken about trade. Both lambaste trade deals as job killers.

People who were born before 1940 and managed to die before 1990, probably got their womb-to-tomb security. The first signs of change began in the 1960s, when finished textile products were moved to Central America and Asia. Such manufacturing was once a staple of New England before World War II but, with the advent of air conditioning, plants moved to the Southern states - then the land of cheap labor - in order to reduce costs.

There are many examples of U.S. plants moving to nations with low-cost labor, including the closure of the Philadelphia Nabisco plant in 2015 and the Chicago operation in 2016. Oreos and other Nabisco brands - including Ritz, Nutter Butter, Nilla Wafers, Honey Maid, Premium and Wheat Thins - will be produced in Mexico to be sold across North America.

There are many examples of U.S. plants moving to nations with low-cost labor, including the closure of the Philadelphia Nabisco plant in 2015 and the Chicago operation in 2016. Oreos and other Nabisco brands - including Ritz, Nutter Butter, Nilla Wafers, Honey Maid, Premium and Wheat Thins - will be produced in Mexico to be sold across North America.

Ford Motor Company is investing $1.6-billion to build another new Mexican factory - this one in San Luis Potosi.

Construction will begin this summer and it's expected to begin producing cars by 2018. About 2,800 people will be employed at the facility by the end of the decade. Ford hasn't announced which vehicle or vehicles will be built at its newest Mexican factory, but they will be in the small car segment. Ford already builds the Fiesta in Cuautitlán Izcalli.

But it's not just outsourcing to low-wage countries that's taking away jobs: The development of the web and high-speed internet caused many manned business functions to be moved online. Customers can now search inventory, make travel arrangements (air travel, rental cars and lodging) online, without human contact.

Clerical and support positions are going away. Such jobs used to provide a very decent living for earnest, smart high school grads and college graduates with unmarketable degrees (Humanities, Social Studies, Poetry, Music, et al). This is the dark side of productivity. When you can post your inventory on the web for prospects to browse and select, you no longer need 'Lemme' support staff to answer phones and say, "Lemme check our inventory list." Or, "Lemme see if we have room available at that hotel on the dates you requested."

Online stores are replacing brick-and-mortar establishments, eliminating retail employment - no counter jockeys, sales 'associates' or stock boys needed on the 'net. The ability to send large files back and forth between countries via the internet has impacted jobs in design, medical scan analysis, hard tooling/machining and other formerly 'safe' fields of American employment. Within the U.S., automation - especially robotic devices - has further eroded the job market.

Back in the mid-1980s, my plastics manufacturing business purchased a Tennant self-propelled floor sweeper to replace daily manual clean-up by all employees at the end of each shift. Based on labor savings alone, the machine paid for itself in two months. At the time, our firm was growing rapidly so no one was laid off. But the idea that even simple machines could reduce the need for more employees became imprinted in my mind.

Today, it's a new world and, while candidates Bernie Sanders and Donald Trump talk about righting perceived trade agreement wrongs, they won't be able to turn the clock back on the various forms of job-killing technology. All of the companies where I once worked are now gone (bankrupt, merged out of existence, etc.). Same for my dad and both of my grandfathers. Progress has a price. (posted 4/7/16, permalink)

Wild Rides: Did your 401K run out behind the Dumpster and throw up last Friday night? Well that's what happens when the world's economies are being run like some out-of-control amusement park and your money has been taking all the rides on a fully-invested stomach.

Wild Rides: Did your 401K run out behind the Dumpster and throw up last Friday night? Well that's what happens when the world's economies are being run like some out-of-control amusement park and your money has been taking all the rides on a fully-invested stomach.

Your life-savings white-knuckled the grab bar on the big 'ol Dow Roller Coaster when it dropped over 530 points Friday - more than 3% - in one day. The DJIA was down 7% for the week - the worst weekly decline since October 2008, during the Mega Financial Meltdown Armagedon.

The Slip-N-Slide Oil Ride has gotten too slick; oil has dropped to below 40 bucks a barrel and consensus is that the global gut of oil will be around for a while. That's, of course, if you believe that Consensus can be found in an amusement park.

In the short term, cheap oil will make for queasiness in the energy sector of the U.S. economy. In the long term, it could decimate the Iranians, Saudis and our other 'friends' in the Middle East. So, it's not all bad. Just put your head between your knees, breathe deeply and repeat the mantra, 'Keystone Pipeline, Keystone Pipeline', until your tummy settles.

Our economy has digested too much fluffy Cotton Candy (aka - Quantitative Easing) served up by the Fed. Now the room is starting to spin and we don't feel too well. Shouldn't have gone on that last ride. Time to pay the piper.

All those smart financial advisers who were pushing International Investing are now hiding in a back booth at the International House of Pancakes. The Japanese Nikkei fell 3% Friday and Hong Kong's Hang Seng Index dropped enough that poor old Seng actually went out and hung himself.

China's Mystery Dragon Ride - the cause of much of this mess, with its inscrutable economy and rigged currency - has experienced a stock market drop of more than 32% since June. Manufacturing in China is now at a six-and-a-half year low. How's that for noodles, pal? You should never, never eat Chinese at an amusement park. If you do, you'll soon be blowing chunks. Or Chun King.

Europe is reeling, too - the Germany's DAX is upset, dropping sharply. When a a German comic book character is vomiting, the word balloons always read, "Dax! Urrgh! Dax!" It's probably because of all that Greek yogurt they've been forced to eat.

Britain's FSTE 100 (sounds like the name of an rickety old bumper car) fell almost 3%. Knocked the Queen's crown askew, it did, guv. Ready for a swig of Pepto Bismol yet, old chap?

So what should you do? Maybe you should invest in health care stocks; they have outpaced the general stock market for 30-plus years. I have no other recommendations to make: TIPS are in negative territory, the outlook for bonds isn't so hot, I think gold is a fool's errand (unless you believe those William Devane TV ads because he's old, wizened and looks vaguely like a Kennedy) and you'd be lucky to find a money market account paying much of anything.

I suppose you could hoard Forever stamps and canned goods if that makes you feel better.

As for me, I'm hanging in there. Things will get better - they always do. "There's got to be a morning after," a hopeful Maureen McGovern used to sing. I'd rather bet on her than the soothsayers at IHOP. (posted 8/24/15, permalink)

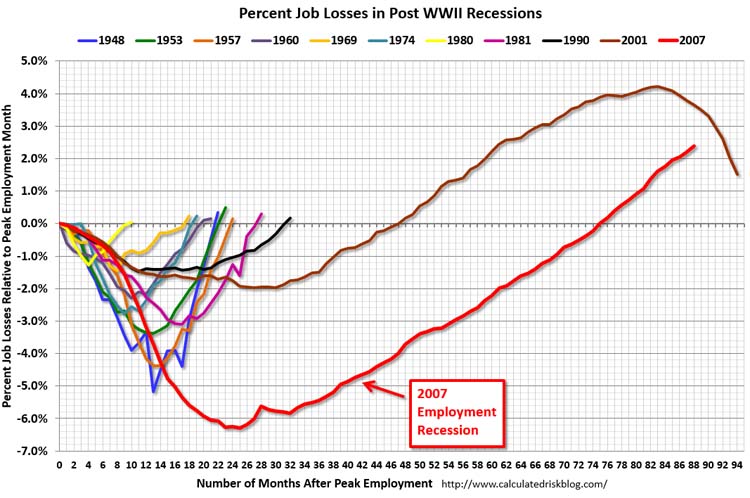

Jobless Recovery Explained: Recently, Bill McBride posted a graph showing job losses and recovery times for post-World War II recessions.

In the past, typical recessions took 10-23 months for job recovery. The recovery timeline began to stretch beginning with the recession of 1981. Here are the data:

|

Recession Beginning In:

|

Time for Job Recovery

|

|

1981

|

27 months

|

|

1990

|

31 months

|

|

2001

|

47 months

|

|

2007

|

75 months

|

What has caused this alarming acceleration? A combination of technology and outsourcing.

Outsourcing began in the 1960s when finished textile products were moved to Central America and Asia. Such manufacturing was a staple of New England before World War II but with the advent of air conditioning moved to the Southern states - then the land of cheap labor - in order to reduce costs.

Moving manufacturing jobs outside of the U.S. gathered more steam in the 1970s and by the 1980s had become a fact-of-life in many industries. I remember when the manufacture of cell-cast Plexiglas acrylic sheet was moved from plants in Pennsylvania and Tennessee to Mexico in the early 1980s. Pundits in the plastics industry referred to the resultant product as 'Mexiglas'.

The move to Mexico was an attempt to reduce costs in order to compete with Asian-produced cell-cast acrylic, which had cut heavily into the sales of thick Plexiglas especially along the West Coast. And had been doing so since the early 1970s.

Terence P. Jeffrey wrote, "Manufacturing employment in the United States peaked 36 years ago in June 1979. That month, the U.S. had a civilian labor force of 104,638,000 and 19,553,000 - or about 18.7% - were employed in manufacturing. Last month, the U.S. had a civilian labor force 157,469,000, but only 12,355,000 - or about 7.8% - were employed in manufacturing. Between those two dates, the number of Americans who held a job or actively sought one increased by 52,831,000. But manufacturing jobs declined by 7,198,000. In 1979, when manufacturing jobs peaked, households headed by Americans who had completed high school but not attended college ... enjoyed a median income of $54,503 in constant 2013 dollars. In 2013, the latest year on record, those households had a median income of $40,701 in constant 2013 dollars - a real drop of $13,802."