Finance and the Economy - 2013-14

More recent 'Finance & The Economy' posts can be found here.

Bad Investments: In a year when the S&P 500 is up over 13%, the Nysa Fund is the worst performing mutual fund of 2014, down 41% so far this year. "The fund received just one out of five stars from Morningstar, the worst rating for past performance awarded." Bad Investments: In a year when the S&P 500 is up over 13%, the Nysa Fund is the worst performing mutual fund of 2014, down 41% so far this year. "The fund received just one out of five stars from Morningstar, the worst rating for past performance awarded."

As for individual stocks, one of the year's big losers is Amedica, a manufacturer of silicon nitride orthopedic and spinal implants. Shares have fallen by more than 90%. "With a book value of just under $12 million and nearly $5 million in losses in the last quarter, Amedica is quite small and quite risky." By comparison, many health care mutual funds are up about 30% so far in 2014.

Regarding fiat money, this was not a good year to bet against the dollar which has risen in value compared with other currencies. "No currency has slumped more against the dollar than the Russian ruble, which has dropped 39% this year vis-a-vis the dollar. While selling rubles and buying dollars would have produced the largest gain in 2014, buying the ruble and selling the dollar would have produced the largest loss.

The declining ruble has be painful for many Russians. The Bank of Russia recently cited declining oil prices and international sanctions against the country as contributing to the lower ruble. In an effort to control high inflation resulting from the currency weakness, the central bank raised interest rates."

If you've not invested in the Nysa Fund, Amedica or rubles, give yourself a pat on the back. (posted 12/12/14, permalink)

How To Lose Jobs In One Easy Lesson: Seattle, Washington, one of the strongest bastions of lefty philosophy, passed a phased-in $15 per hour minimum wage law earlier this year. The council vote was unanimous and a throng of clueless morons outside cheered, but for many this will soon become a reversal of fortune.

In response to Seattle's coming $15 minimum wage - the highest in the U.S., Kathrina Tugadi, owner of Seattle's El Norte Lounge - a bar/restaurant in North Seattle featuring Mexican dishes, no longer hires musicians for her restaurant; she said she can't justify expenses that don't directly "add to the bottom line." And, she says, hours will have to be cut: El Norte Lounge stopped serving lunch and only serves dinner now. She's also removed labor-intensive menu items and adjusted prices in preparation for the hike. In response to Seattle's coming $15 minimum wage - the highest in the U.S., Kathrina Tugadi, owner of Seattle's El Norte Lounge - a bar/restaurant in North Seattle featuring Mexican dishes, no longer hires musicians for her restaurant; she said she can't justify expenses that don't directly "add to the bottom line." And, she says, hours will have to be cut: El Norte Lounge stopped serving lunch and only serves dinner now. She's also removed labor-intensive menu items and adjusted prices in preparation for the hike.

"I am concerned about my business and others in the community, but it isn't just about any one business. It's about how the entire economic community," she said. "El Norte may be unable to remain open once the ordinance is fully in effect." Even Pagliacci Pizza, a Seattle-area pizza chain, is moving its call center and some of its production facilities outside the city. Bye-bye Seattle jobs.

Back in the mid-1980s, my plastics business purchased a Tennant self-propelled floor sweeper to replace daily manual clean-up by all employees at the end of each shift. Based on labor savings alone, the machine paid for itself in two months. At the time, our firm was growing rapidly so no one was laid off. But the idea that machines can reduce the need for more employees was imprinted in my mind.

Karl Denninger wrote, "Welcome to this thing called arithmetic folks, and for those of you who thought you could cram this down employer's throats, no, you can't, for the simple reason that for most employers labor is one of, if not the largest cost of their operation. Adding 30% or more to that operating cost will turn a profit into a loss at which point the company ultimately goes out of business and then you no longer have a job.

Stupidity has a price - in this case the price is that you get to live under a freeway overpass."

This is what happens when you let liberal politicians who have never run a business or made a profit call the shots. This is how socialism begins ... and eventually fails. (posted 12/10/14, permalink)

Buy The Merchandise, Not The Stock: Amazon just reported its largest quarterly loss in 14 years.

A surge in spending on new-product development, music and video licensing, and other parts of the Seattle company's expansion strategy led to a net loss of $437 million in the third quarter, worse than its year-earlier loss of $41 million. The wider loss came despite a 20% jump in revenue to $20.6 billion. It's the usual excuse: the company is still "ramping up" - the same old saw Amazon has been pushing since it was a mere $3 billion company in 2000. How can you be still in ramp-up mode as a multi-billion dollar entity?

Karl Denninger wrote, "I've been amazed for years that the market has given Bezos a pass on actually earning anything at all on these ambitions. Profits will come, we're told, but the obvious question is "when??"

It has appeared for a couple of years now that the answer was always destined to be never, and that the only way Amazon could possibly maintain its alleged "growth" was to basically give away product, R&D and fulfillment at below the cost of production.

That shouldn't surprise at all; it's usually very easy to be "successful", measured by the number of units of "X" you deliver, if you don't care if you make any money doing it!

If Amazon can't actually turn a profit while operating then I argue the stock is worthless." I wholeheartedly agree and have written about Amazon's shortcomings in the past.

Amazon missed expectations across the board - on margins, on its net loss and on revenue. Plus, an unaccountably poor 7 to 18% revenue growth was forecast for the typically strongest holiday quarter. And ... the company is sitting on $83 million of unsold Fire Phones. Amazon touts its cash flow, which looks good only because it takes customers' money right away but doesn't pay suppliers for 75 days. John Thompson, chief executive of Vilas Capital Management, said, "That's an entirely fallacious way of valuing a company."

Like the discount stores of the 1950s and '60s, (E.J. Corvette, Two Guys, S. Klein, etc.), margins and profits have always been low to nonexistent. And you know what happened to those guys. (posted 10/24/14, permalink)

A Whale Of An Economic Change: Many high-wage American jobs have disappeared and are not coming back. I have outlined some of the reasons here. A Whale Of An Economic Change: Many high-wage American jobs have disappeared and are not coming back. I have outlined some of the reasons here.

America has been undergoing a revolution. The corporate womb-to-tomb culture is dead. Job skills no longer last a lifetime because new technology makes old skills obsolete - quickly. In order to move up the ladder, one must constantly be on the lookout for new opportunities created by change.

The widespread use of computers and the increased use of online sales and service functions means that clerical and support positions are going away. Such jobs used to provide a very decent living for earnest, smart high school grads and college graduates with unmarketable degrees (Humanities, Social Studies, Poetry, Music, et al). This is the dark side of productivity. When you can post your inventory on the web for prospects to browse and select, you no longer need support staff to answer phones and say, "Let me check our inventory list."

Then there's the proliferation of outsourcing/offshoring. Faced with ever increasing labor regulation, upwardly spiraling health care costs and the like, many companies are reducing their workforce by subcontracting - often overseas. Goodbye to high-paying union jobs.

Malcolm Berko summed it up: "It wasn't long ago that big employers such as Maytag, Goodyear and General Motors paid Americans the equivalent of $40 to $60 an hour. Today many of America's largest employers - e.g., Wal-Mart and McDonald's - pay workers $8 to $12 an hour. And like it or lump it, folks making $12 an hour can't afford to travel to SeaWorld from Oregon, Oklahoma or Ohio and pay an entry fee of $260 for a family of four plus $175 for a hotel room."

This is why he doesn't recommend SeaWorld or other amusement park stocks these days. (posted 10/20/14, permalink)

Where Are All The Entrepreneurs? The rate at which new companies are being formed has fallen steadily for over three decades - almost 30%. By other measures - as a share of all businesses or relative to the size of the working-age population - it has fallen in half. This is a major problem, since the vast majority of new U.S. private-sector jobs (75%-90%, depending upon which data source you choose) are created by small businesses. Where Are All The Entrepreneurs? The rate at which new companies are being formed has fallen steadily for over three decades - almost 30%. By other measures - as a share of all businesses or relative to the size of the working-age population - it has fallen in half. This is a major problem, since the vast majority of new U.S. private-sector jobs (75%-90%, depending upon which data source you choose) are created by small businesses.

This decline has occurred nationwide - even in tech-heavy, entrepreneurial Silicon Valley. Business creation there is still higher than the rest of the country, but it's down markedly from the past, according to the Brookings Institution.

"The first reaction of everyone who sees this is they can't believe it, especially anyone from California," said Bob Litan, a senior fellow at the Brookings. "It's down everywhere. In every locale. In every industry."

The article suggests some generalized reasons for the decline: "Increased risk aversion among workers, shifts in government regulation and a consolidation in corporate America that has left many industries dominated by a handful of behemoths." Also noted: "The drop has been sharpest among the millennial generation, which is grappling with heavy student debt and a frustrating job market, according to research by Robert Fairlie, an economist at the University of California, Santa Cruz. People ages 20 to 34 created 22.7% of all new companies last year, down from 34.8% in 1996."

I would posit four additional reasons for the decline in small business formation:

• The Death Of Retail: Everywhere I look, I see retail space for rent. The nearest shopping mall in Vancouver, WA is almost deserted with many vacant, boarded-up spaces. Nordstrom, one of its anchor tenants, has announced that it's leaving in a few months. Even the kiosks were sparse and many of the remaining shops seem to specialize cheap imported impulse items.

In the U.S., shopping mall traffic peaked in the late 1980s and has been slipping ever since. More than 300 U.S. shopping malls have closed in recent years.

• The Disappearance Of Local Lending Institutions: Business loans for young companies are extremely hard-to-get because the locally-owned bank has become a rarity. No longer is there a hometown bank executive who keeps his nose to the ground, has significant personal lending authority, makes loans based partly on the character of his clients, is guided by a loan committee of other knowledgeable locals and knows his market because he attends local business events and networks.

He has been replaced by a well-dressed employee-drone of some mega-bank, who has almost zero lending discretion and knows little about the business community he/she serves. Decisions are made by a committee of uninvolved managers thousands of miles away based on a proprietary, arbitrary scoring system.

Mega-banks have raised lending standards through the roof.

• The Unbearable Burden Of Regulations: The annual cost of all mandated Federal regulations for firms with less than 20 employees is estimated at over $15,000. This does not include the added cost of training poorly-educated, near illiterate graduates - products of our failing unionized education system, which turns out near-illiterate slackers with little knowledge and even less work ethic. Add in mandated health care costs, the cost of litigation insurance (product liability, employee negligence) and the risk/reward ratio for business ownership becomes unattractive.

Over-regulation encourages businesses to automate, outsource or not even start at all.

• The Disposable Society: We live in an age of devices and items which cannot be repaired. This has led to a dramatic decline in fix-it shops of all types, including television/electronics repair firms, furniture refinishing places, automobile tune-up shops, engine rebuilders, clothing alteration stores and shoe repair establishments.

People would rather buy cheap footwear made in some Third World country and, when a hole appears in the bottom, toss them in the trash.

California is the poster child for the anti-business climate. Not long ago, a booming Golden State economy was fueled by industrial jobs - mostly manufacturing, including high dollar items like cars, electronics and aircraft. Today, the factories are largely gone, driven out by the high cost of doing business and by a left-wing legislature that doesn't seem to care, making ghost towns and ghettos of once-thriving metropolises.

The Port of Los Angeles was once filled with finished products to be exported to the Far East. Today, much of LA's exported product is waste paper - shipped to Asia to be converted to cardboard boxes for shoddy manufactured goods exported to the United States. (posted 10/8/14, permalink)

No Ally Of Mine: Tempted by its relatively high-money market rates (which are still very low but five times better than the best rates locally - these days most local banks offer about the same compound interest as a sperm bank), I tried to do business with Ally Bank. I filled in all the paperwork and mailed a check, since I do not do banking or investment transactions online. No Ally Of Mine: Tempted by its relatively high-money market rates (which are still very low but five times better than the best rates locally - these days most local banks offer about the same compound interest as a sperm bank), I tried to do business with Ally Bank. I filled in all the paperwork and mailed a check, since I do not do banking or investment transactions online.

The check was mailed August 15th. Then the 'fun' began. First, Ally claimed that I failed to send page two of my application. Not true, Ally lost it. They sent another one. I filled out the second page and mailed it.

Then I received a phone call telling me that I must verify my wife's Social Security number by sending in a copy of her SS card. In my fifty-plus years of banking, I've never received such a request. Frustrated, I told them to tear up my application and return my check. They failed to return the check and it took multiple calls to get them to do so.

My advice - don't do business with Ally Bank, formerly GMAC. Its personnel are unempowered, clueless and incompetent. (posted 10/6/14, permalink)

A Graphic Jobless Recovery: Scott Grannis has posted a graph which is worth a thousand words.

He wrote, "The six-month annualized growth rate of private sector jobs is still just a bit above 2%, the same rate we have seen since early 2011. ... Public sector jobs are no longer declining, and are now growing very slowly. The labor force is still growing at a miserably slow rate."

Overall, the jobs picture has been mostly flat during this 'recovery'.

Scott continued, "It's still a very sub-par recovery. There is no sign of a recession or a boom. Things are not likely to change materially unless and until we get some improvement in fiscal policies (e.g., reduced regulatory burdens, lower and flatter marginal tax rates)." (posted 9/26/14, permalink)

My Grandmother Had The Right Idea: The Vanguard Wellington Fund, the nation's oldest balanced fund, recently celebrated its 85th birthday. My Grandmother Had The Right Idea: The Vanguard Wellington Fund, the nation's oldest balanced fund, recently celebrated its 85th birthday.

The Wellington Fund began operations on July 1, 1929, just months before the worst stock market crash in U.S. history and the onset of the Great Depression. A young Philadelphia accountant named Walter L. Morgan was its founder and offered a diverse portfolio of common stocks, preferred stocks and high-quality corporate and U.S. government bonds. Despite Walter's awful timing, the groundbreaking fund - originally called the Industrial and Power Securities Company - hung on, thanks to its prudent management, balance, diversification and long-term perspective.

But the fund (which was renamed in 1935 for the Duke of Wellington, who defeated Napoleon at Waterloo) didn't simply survive - it thrived. For more than eight decades, Wellington Management Company has served the fund's shareholders well, using the very same investment principles that guided it through the Great Depression. And those timeless themes still ring true today.

Wellington isn't very flashy and gets little notice from those investment gurus du jour. But, as I got older, I began to shift some of my investments away from growth mutual funds into Wellington. I have not been disappointed.

In the 1950s, my grandmother owned Wellington Fund shares and during her 90-year life, she never ran out of money.

Interestingly, an investment of of $1,000 in July, 1929 would be worth almost $900,000 today. That's the power of long-term investing.

Morningstar rates Wellington as a five-star fund, noting that an investment of $10,000 five years ago is now worth $17,828. (posted 8-29-14, permalink)

A Voice Of Reason In The Car-Peddling Game: Criticizing longer loan-terms and looser underwriting standards for new vehicle loans, John Mendel, Honda's head of sales, said, "It's a very, very short-term tactic … especially in the subprime area, because you not only are pulling sales forward, you're probably pulling people out of used cars into a new car that maybe they can't afford."

Stating that the new car market was "near the top," Mendel said that Honda would continue to focus on retail sales, rather than pivot towards more fleet delivers like many of its rivals do. Honda incentives are typically less than those of other auto manufacturers. Stating that the new car market was "near the top," Mendel said that Honda would continue to focus on retail sales, rather than pivot towards more fleet delivers like many of its rivals do. Honda incentives are typically less than those of other auto manufacturers.

Near the top? Very possibly so. The latest second-quarter 2014 data from Experian, the global financial/credit information services group, was released this week; key metrics like repossessions, loan delinquencies and outstanding balances have all seen increases. Auto loan balances are at a new high.

Outstanding balances were up nearly 12%, rising to an all-time high of $839.1 billion dollars. 60-day delinquencies were up 7%, while 30-day delinquencies were up to 2.4% year over year. Repossessions were up by 70% in the same time period.

Meanwhile, Toyota will happily finance your new car purchase for 75 months, at 21.40% interest, if your FICO score is 520. People with scores that low are the ones in line in front of you at a convenience store, buying chewing gum with a Visa debit card. Or an EBT card.

Seventy-five months - are you kidding? Oh well. At least it's not a Fiat they're financing. I don't think those crapmobiles will last 6-plus years. (posted 8-25-14, permalink)

Change Happens: Mark Perry of AEI noted that 88% of the companies on the 1955 Fortune 500 list have either gone bankrupt, merged, or still exist but have fallen from the top Fortune 500 companies (ranked by total revenues). "Most of the companies on the list in 1955 are unrecognizable, forgotten companies today (e.g. Armstrong Rubber, Cone Mills, Hines Lumber, Pacific Vegetable Oil, and Riegel Textile)." Also gone from the list: American Motors, Brown Shoe, Studebaker, Collins Radio, Detroit Steel, Zenith Electronics, Rohm and Haas and National Sugar Refining.

All the companies I worked for are gone (bankrupt, merged out of existence, etc.). Same for my dad and both of my grandfathers. (posted 8-25-14, permalink)

Lost In The Amazon: The online retailer released its quarterly earnings last week. Revenues are rising but expenses are going up even faster. Shipping expenses are up 30%. Marketing is up 40%. International is slowing - it's up 18% on sales while domestic is up 26%. Operating margin is negative.

Amazon makes almost nothing on sales other than media. Basically, they sell things like electronics at break-even. Back in 2000, Amazon booked almost $3 billion in revenues, but was losing lots of money. Jeff Bezos, founder and CEO of Amazon.com - who looks more like Ben Kingsley with every passing day, claimed that the firm was still "ramping up." How can you be still in ramp-up mode as a multi-billion dollar entity?

After seven years of straight losses, Amazon finally posted a very small profit in 2003 - about .02% before taxes on over $5 billion in sales. Like the discount stores of the 1950s and '60s, (E.J. Corvette, Two Guys, S. Klein, etc.), margins and profits were always low. And you know what happened to those guys.

Amazon's shares fell 9.6% last Friday, wiping out about $16 billion of value. The company has now fallen short of Wall Street's earnings expectations in seven of the past nine quarters. Perhaps worse, it predicted an operating loss of up to $810 million for the current third quarter, the biggest quarter-on-quarter reversal in profitability since 2003.

"It does get frustrating when they continue to spend quarter after quarter and they don't let the revenue flow through," said Michael Scanlon, who manages $3.5 billion at Manulife Asset Management and holds shares of Amazon. "I'm definitely ready for profits."

My advise: Buy 'stuff' from Amazon if you want but don't buy the stock. (posted 7-30-14, permalink)

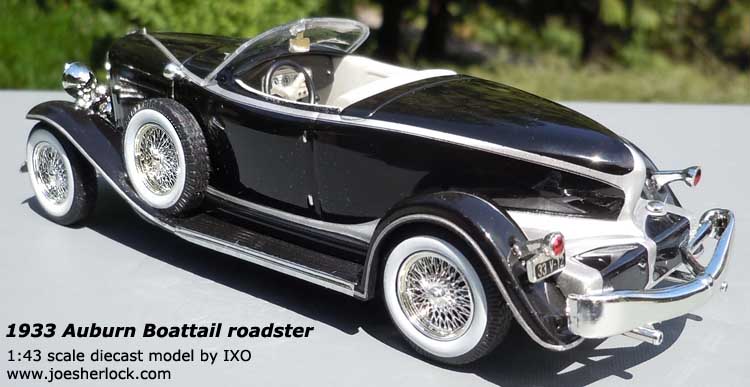

The Trouble With China: In a recent issue of Model Auto Review, a model car manufacturer wrote about the problems with producing diecast models in China.

"China is emerging as a world power and, like most growing economies, its cost structure is rising. China has now ruled that workers must get an annual salary increase of 15% and this is adding to the cost of product. The Chinese government has ruled that major industries such as mobile phones, computers, and iPads get priority for land space and other less-clean industries such as diecasting must move location. This all adds up to increases in price of product and delays in delivery."

Another model manufacturer wrote, "The lack of skilled workers in China is still the big factor restricting manufacturing capacity and causing delays."

Five years ago, the German firm Minichamps offered very nicely made diecast 1:43 scale Chinese-made models for $22-30. Today's Minichamps models carry price tags of $55-95. Ixo models have more than doubled in price over the last few years. Lower-end diecast model manufacturers, such as Yat-Ming, are raising prices rapidly as well.

In many sectors of manufacturing, production and shipping costs in the Far East now outweigh costs to make the same item in the U.S. When you take into account shorter lead times, the ability to switch production to a different product if you own the factory, rather than being contracted to a Chinese supplier, and the sales benefit of a 'Made in USA' sticker, there is starting to be a good business case for bringing some manufacturing back home. (posted 1-31-14, permalink)

Book Review: 'Bull By The Horns: Fighting to Save Main Street from Wall Street and Wall Street from Itself' by Sheila Bair

As former Chairman of the FDIC (Federal Deposit Insurance Corporation), Bair had a somewhat prominent role in the government's response to the financial crisis of 2008, including bolstering public confidence and insuring system stability that resulted in no runs on commercial and thrift bank deposits.

While the book offers a detailed - too detailed and off in the weeds sometimes - story of the meltdown of Wall Street's largest institutions and the bailouts made to them, there was ... (more >>>)

Anemic Recovery Blues: Bill McBride of Calculated Risk has posted an updated graph comparing job losses and recovery rates for various post-WWII recessions.

The graph "shows the job losses from the start of the employment recession, in percentage terms ... aligned at maximum job losses."

As the graph clearly indicates, this is the worst recession since World War II - by a long shot - in both depth and duration.

This time, the economic recovery graph is not the historical bounce-back V-shape we're used to seeing but rather a lame, check mark-shaped one. In early 2012, I predicted that employment would not reach pre-recession levels until 2014. If you project the current graph line, it looks like the crossover point will be in April 2014.

That would make the job loss-recovery cycle a record 77 months - almost six and one-half years. The previous record time span was for the 2001 recession, which clocked in at 46 months and was lambasted by Democrats as a 'jobless recovery'. Hmmmm. What will they call this one?

Why is it so different this time around? I would posit that we have been subjected to The Perfect Storm. This is what happens when you run your banking system like a dysfunctional three-card monte game, outsource all your subassemblies to Asia, close plants in Indiana and Michigan and move production to Mexico, close the tech support center in California and open one in Bangladore ... and vote for politicians who enact policies which make the aforementioned business actions the sensible thing to do.

As Scooby Do would say, "Ruh-roh!"

Consider the following:

•  The increased use of online sales and service functions means that clerical and support positions are going away. Such jobs used to provide a very decent living for earnest, smart high school grads and college graduates with unmarketable degrees (Humanities, Social Studies, Poetry, Music, et al). The increased use of online sales and service functions means that clerical and support positions are going away. Such jobs used to provide a very decent living for earnest, smart high school grads and college graduates with unmarketable degrees (Humanities, Social Studies, Poetry, Music, et al).

This is the dark side of productivity. When you can post your inventory on the web for prospects to browse and select, you no longer need support staff to answer phones and say, "Let me check our inventory list for you."

• Then there's the proliferation of outsourcing/offshoring. Faced with ever-increasing labor regulation, upwardly spiraling health care costs and the like, many companies are reducing their workforce by subcontracting - often overseas.

• The annual cost of all mandated Federal regulations for firms with less than 20 employees is estimated at almost $8,000. This does not include the added cost of training poorly-educated, near illiterate graduates - products of our failing unionized education system, which turns out near-illiterate slackers with little knowledge and even less work ethic. This encourages businesses to automate or outsource.

• Many of those who have not experienced offshoring end up as freelancers with no benefits or job security. Popular alternative euphemisms include 'contingent worker' and 'temp independent consultant'. This is the new workplace world and it means that many well-educated, middle-class folks are now finding themselves 'underemployed', with reduced hours and little if any job security. Much like ditch diggers in 1913.

• In the past, technological changes simply shifted opportunity within the U.S. As farm jobs were eliminated by mechanization, factories hired more. As factories increased productivity and moved work offshore, more Americans turned to lower-pay jobs in health care and other services.

But nothing in any economic database indicates that the supply and demand for workers will intersect at a wage that is socially acceptable. Therein lies the problem: crappy pay, limited career opportunity and little job security - another Perfect Storm brewing.

To be sure, low-paying jobs in restaurants, nursing homes and health clubs are hard to automate or outsource and will probably always be around. But how do we make America the Land of Opportunity again?

There are no easy answers. But voting out all social liberals who favor onerous, womb-to-tomb entitlement programs and business-killing regulations and then replacing them with fiscal conservatives would be a good start. (posted 11-15-13, permalink)

Off-Target: A target-date fund - sometimes called a life-cycle fund - is a mutual fund which uses a time-variable ratio of stocks to bonds. It's a mindless sort of investment which gradually shifts its holdings towards bonds as an investor's age climbs. Off-Target: A target-date fund - sometimes called a life-cycle fund - is a mutual fund which uses a time-variable ratio of stocks to bonds. It's a mindless sort of investment which gradually shifts its holdings towards bonds as an investor's age climbs.

Target-date funds are aimed at retirement plans and have appeal because they "offer a lifelong managed investment strategy so should remain appropriate to an investor's risk profile even if left accidentally unreviewed."

Ummmm ... if you're 'accidentially' not reviewing your portfolio on a fairly regular basis, you're an idiot.

There is an old saw that you take your age and subtract it from 100. The remainder is the percentage of stocks which should be in your investment portfolio. So if you're 65, you should have 35% in stocks and the rest in bonds.

Such a simplistic formula may have been relevant a half-century ago but the bond markets of recent years are not always the safe harbor they used to be. Bond-heavy portfolios seem to be a bad bet these days. Consider the annual returns on these Vanguard mutual funds over various time periods:

| Investment |

Allocation |

1 Year

|

3 Year

|

5 Year

|

10 Year

|

2008 return

|

| Index 500 Fund |

100% stocks |

24.9%

|

16.4%

|

16.8%

|

7.5%

|

-37.0%

|

| Wellington Fund |

66% stocks; 34% bonds |

16.2%

|

11.9%

|

14.5%

|

8.5%

|

-22.2%

|

| Wellesley Fund |

40% stocks; 60% bonds |

7.8%

|

9.2%

|

12.2%

|

7.5%

|

-9.8%

|

| Total Mkt. Bond Index Fund |

100% bonds |

-0.9%

|

2.8%

|

5.5%

|

4.7%

|

5.1%

|

| Capital Opportunity Fund |

100% high-growth stocks |

40.5%

|

15.7%

|

19.0%

|

10.2%

|

-39.0%

|

| Health Care Fund |

100% health care stocks |

35.0%

|

19.9%

|

18.3%

|

11.2%

|

-18.4%

|

| Dividend Growth Fund |

100% dividend-paying stocks |

27.8%

|

15.9%

|

15.6%

|

9.3%

|

-25.6%

|

I'm not a subscriber to the Lotsa Bonds For Geezers school of thought but I am of the opinion that as one ages, one should move one's portfolio away from high-risk, volatile stocks into more conservative equity investments. With a few bonds thrown in for good measure.

It seems that I'm in the minority these days. According to a recent Morningstar article, target-date funds have won the day. "Almost unanimously, plan sponsors are selecting target-date funds as the repository for automatically enrolled monies (at Vanguard, the figure is 90%). With those assets growing, and target dates remaining popular with investors who make active investment choices, target-date funds are becoming very popular indeed."

"Half of Vanguard's participants use target-date funds in some fashion. Many own either multiple target-date funds or a target-date fund plus other types of funds, which isn't how target dates were designed to be used but is mostly harmless. (Having several target-date funds makes for a blurry picture, but the performance tends to be pretty much like that of the middle fund in the series.) The other half, or 27% in total, own nothing but a single target-date fund. In 2007, that figure was 13%."

Not me. I'll set my own targets. I'm still over 85% invested in equities (mostly mutual funds); the balance is in cash and bonds - even though the numbers crunchers at one of my mutual fund companies thinks that I should have 55% of my money in bonds. No thanks. (posted 10-31-13, permalink)

Nothing Has Been Solved: The alleged 'resolution' of the debt crisis is nothing more than kicking the can down the road. And failing to turn down the spigot:

No steps have been taken to reduce our ever-increasing debt, which is rising at an alarming rate. Daniel Halper of The Weekly Standard has pointed out that the debt has "increased twice as much as the economy over the last two years, the very definition of unsustainable. The growth of a nation's debt cannot for long exceed the growth of its economy - which is precisely what is happening now."

Political wrangling has trumped common sense.

Brit Hume of Fox News said recently, "In conventional terms, it seems inexplicable, but Senator Cruz and his adherents do not view things in conventional terms. They look back over the past half-century, including the supposedly golden era of Ronald Reagan, and see the uninterrupted forward march of the American left.

Entitlement spending never stopped growing. The regulatory state continued to expand. The national debt grew and grew and finally in the Obama years, exploded. They see an American population becoming unrecognizable from the free and self-reliant people they thought they knew.

And they see the Republican Party as having utterly failed to stop the drift toward an unfree nation supervised by an overweening and bloated bureaucracy.

They are not interested in Republican policies that merely slow the growth of this leviathan.

They want to stop it and reverse it. And they want to show their supporters they'll try anything to bring that about."

Keith Koffler commented on the D.C. state of dysfunction "brought to you by the 'reasonable' people who have been striking deals for years that have created $17 trillion in debt and a possibly irreversible degree of Socialism that is lobotomizing our tradition of independent thinking and creativity, crippling free enterprise, and carving the soul out of the moral, God-fearing ethic that has made this nation the greatest on earth."

"You'll see them all on the Sunday talk shows, concurring solemnly with each other about the need to avoid such shenanigans again so our system can resume functioning in a normal manner.

But as you and I know, 'normal' has become a state of somnolence in which our leaders steadily sleepwalk us into the abyss."

We must cut spending. Here are some facts to consider:

• Salary of U.S. President: $450,000 for life

• Salary of House/Senate Members: $174,000 for life

• Average salary of soldier deployed in Afghanistan: $38,000

• Average annual payment for seniors on Social Security: $14,760

Now you know where to begin. At the top.

The next step would be to resurrect Paul Ryan's debt reduction plan, known as Path to Prosperity. Or Simpson-Bowles, a bipartisan commission created by President Barack Obama, whose recommendations were completely ignored by him and his cohorts in the Democrat-controlled Congress. (posted 10-18-13, permalink)

Book Review: 'Circle of Friends: The Massive Federal Crackdown on Insider Trading - and Why the Markets Always Work Against the Little Guy' by Charles Gasparino

As senior correspondent for the Fox Business Network and the Fox News Channel, Charles Gasparino is a familiar name and face to many. He reports knowledgeably on major developments in the world of finance and politics and is a former writer for the Wall Street Journal.

The author relates the story of government investigators and prosecutors as they pursue one of the most aggressive and broad-reaching - perhaps overreaching ... at great expense to taxpayers - series of insider-trading cases in the nation's history. Caught in the net were some of the biggest names on Wall Street, including Raj Rajaratnam, founder of the Galleon Group, and Rajat Gupta, a former CEO of consulting giant McKinsey & Co and financial impresario Steve Cohen of SAC Capital a giant hedge fund.

Near the end of the book ... (more >>>)

I Am Becoming My Grandmother. The Wellington Fund turned 84 years old in July. Now the nation's oldest and largest balanced mutual fund, its inception was just before the 1929 stock market crash and the Great Depression that followed. Talk about bad timing. I Am Becoming My Grandmother. The Wellington Fund turned 84 years old in July. Now the nation's oldest and largest balanced mutual fund, its inception was just before the 1929 stock market crash and the Great Depression that followed. Talk about bad timing.

A young Philadelphia accountant named Walter L. Morgan was its founder and offered a diverse portfolio of common stocks, preferred stocks and high-quality corporate and U.S. government bonds. Despite a rocky (How about 'cliff-like'?) investment climate during the fund's formative years, Morgan's conservatism and balanced approach paid off. Wellington Fund has produced an 8.2+% average annual return since its 1929 inception and has paid an uninterrupted string of 336 quarterly dividends.

Over the past ten years, its overall performance has been significantly better than the S&P 500. Yet it is far less risky and does not drop precipitously during stock market contractions.

Wellington isn't very flashy and gets little notice from those investment gurus du jour. As I got older, I began to shift some of my investments away from growth mutual funds into Wellington. I have not been disappointed.

But I feel like a geezer ... my grandmother owned Wellington Fund shares in the 1950s. During her 90-year life, she never ran out of money. (posted 9-26-13, permalink)

Big Book: Many years ago, the Sears catalog was marketed as The Big Book. Now that Sears is out of the catalog biz, the title should be awarded to the 580-page Uline catalog. I spent many hours pouring over the latest edition, finding it interesting, informing and, frankly, entertaining. Big Book: Many years ago, the Sears catalog was marketed as The Big Book. Now that Sears is out of the catalog biz, the title should be awarded to the 580-page Uline catalog. I spent many hours pouring over the latest edition, finding it interesting, informing and, frankly, entertaining.

Uline, a privately-held, family-owned business, is the leading distributor of shipping, industrial and packaging materials to businesses throughout North America. The catalog contains all sorts of things, including cardboard shipping containers, plastic bags, janitorial, retail store fixtures, excelsior, boxes for unicycles and even its own brand of gourmet coffee.

In the late 1980s, my manufacturing company was shipping 250-300 boxes of merchandise per day, so we used a lot of cardboard, foam peanuts and other packaging materials. Uline wasn't a supplier for us in those days; it was a strictly a Midwest firm which had been founded in 1980. Today, the company has 10 warehouses across North America and claims that, if you place and order by 6:00 pm, Uline will ship the same day. The catalog states, "99.5% of our orders ship the same day, with no backorders." This is pretty amazing, considering that the firm stocks over 27,000 different items. None of our company's packaging suppliers could deliver that fast and none of them carried as complete a line of shipping supplies as Uline.

By comparison, my plastics firm stocked 525 different items and offered 48 hour shipping - a speed which was considered near-miraculous in the 1980s display industry. Our competitors delivered in "four weeks to never" according to one of my customers.

Uline was started by Liz and Dick Uihlein in their basement. The firm's 200,000 sq. ft. Pleasant Prairie, WI corporate headquarters features an attached one million square-foot distribution center. Uline employs 2,500 people.

In these times of government-subsidized, failing corporate entities, it is wonderful to learn about a company which has succeeded due to hard work, street smarts and the tenaciousness of the owners. (posted 8-28-13, permalink)

The Truth About Tesla: The megahyped electric car start-up "received the $465 mm loan from DOE, but it also benefits from a $7500/car federal subsidy for electric cars. Moreover, it benefits from the State of California's Zero Emissions Credit program. In its infinite wisdom, CA mandated that all the major auto companies sell a certain number of zero emissions vehicles. If they don't they have to buy credits from companies that do make them-namely, Tesla. This was also essential in putting the company in the black in Q1, and the company is sitting on $250 mm worth of these credits. The Truth About Tesla: The megahyped electric car start-up "received the $465 mm loan from DOE, but it also benefits from a $7500/car federal subsidy for electric cars. Moreover, it benefits from the State of California's Zero Emissions Credit program. In its infinite wisdom, CA mandated that all the major auto companies sell a certain number of zero emissions vehicles. If they don't they have to buy credits from companies that do make them-namely, Tesla. This was also essential in putting the company in the black in Q1, and the company is sitting on $250 mm worth of these credits.

IOW, Tesla's profits are courtesy of you, the taxpayer-and also courtesy of the shareholders of Ford, GM, Toyota, Honda, etc."

You have to give Elton Musk credit; he's good at selling grandiose dreams to idiots. Now, he's pushing Hyperloop, "a solar-powered, city-to-city elevated transit system that could take passengers and cars from Los Angeles to San Francisco in 30 minutes." Soon he'll have a bridge in Brooklyn he'd like to sell you. (posted 8-21-13, permalink)

Keep On Truckin': Scott Grannis has noted that "the inflation-adjusted value of U.S. equities has closely tracked the amount of tonnage carried by U.S. trucking services, according to data compiled by the American Trucking Association. Truck tonnage is a reasonable proxy for the size of the economy, so it makes sense that as the economy expands the value of U.S. businesses should rise. At times stocks appear to overshoot or undershoot truck tonnage, but that is likely due to the vagaries of human emotion which tend to magnify the ups and downs of the business cycle." Keep On Truckin': Scott Grannis has noted that "the inflation-adjusted value of U.S. equities has closely tracked the amount of tonnage carried by U.S. trucking services, according to data compiled by the American Trucking Association. Truck tonnage is a reasonable proxy for the size of the economy, so it makes sense that as the economy expands the value of U.S. businesses should rise. At times stocks appear to overshoot or undershoot truck tonnage, but that is likely due to the vagaries of human emotion which tend to magnify the ups and downs of the business cycle."

When my dad worked for the railroad, he would predict economic downturns based on railcar shipments he had to deliver. His forecasts were uncannily accurate and ran about six months ahead of media reports.

Rail shipments as economic indicators may not be as relevant today. The proliferation of Interstate highways facilitated fast delivery of goods by truck and essentially killed off the LCL (less-than-carload) rail shipment market. Almost all large U.S. railroads now focus on long-mileage, point-to-point haulage of carload lots of merchandise. (posted 8-21-13, permalink)

The Truth About Amazon: Last week, Karl Denninger wrote, "Amazon makes almost nothing (gross margin) on sales other than media. Basically, they sell things like electronics at effective break-even. ... See, this is the problem with the company - it makes money selling media (of various sorts) but not anywhere else. Last quarter I identified a monstrous slowdown in international media sales growth - and let's remember that international is 40% of the company's gross." But international sales are down and U.S. sales growth is on the decline."

This quarter, international media went into contraction.

"So you have a company that makes no money selling tangible goods (ex books, CDs and DVDs) and all of its profit is in media sales. Yet media sales growth is down by nearly half y/o/y in the US and is negative ex-US."

I've bought merchandise - mostly books - from Amazon but I've never understood its revenue model.

Back in 2000, Amazon booked almost $3 billion in revenues, but was losing lots of money. Jeff Bezos, founder and CEO of Amazon.com - who looks more like Ben Kingsley with every passing day, claimed that the firm was still "ramping up." How can you be still in ramp-up mode as a multi-billion dollar entity?

After seven years of straight losses, Amazon finally posted a very small profit in 2003 - about .02% before taxes on over $5 billion in sales. Like the discount stores of the 1950s and '60s, (E.J. Corvette, Two Guys, S. Klein, etc.), margins and profits were always low. And you know what happened to those guys.

Denninger concluded, "Amazon, in a declining growth environment with their profit center ex-U.S. gone (no growth) and deteriorating in the US despite all their spending is a company that is effectively worth its book value on PPE and cash. Which is $30/share, more or less."

Amazon currently trades at over $300 per share. I wouldn't recommend it for your retirement portfolio. (posted 8-12-13, permalink)

Replacement Orb: Ben Bernanke is retiring as Fed Chairman and people are speculating about his successor. I vote for the Magic Eight Ball. It requires no salary and provides impartial, Solomon-like economic advice.

Would the Senate confirm the Ball? All Signs Point To 'Yes'. (posted 8-2-13, permalink)

Latest Economic Word: According to Dave Leggett, German Chancellor Angela Merkel "has apparently become fond of a rather crude English language term that is becoming so popular in Germany that it has now been inducted into their equivalent of the Oxford English Dictionary, the Duden."

The word: 'shitstorm'. German language experts voted it 'Anglicism of the year' in 2012 and the Eurozone's economic crisis seems to have propelled the word into wider usage in Germany. Auto sales in Europe are at their lowest in 20 years.

Europe's economy remains in the Dumpster. Great Britain didn't become a European Union member and its economy is in much better shape. Germany is the strongest of the EU countries and its citizens are tired of bailing out weaker, often lazy 'partners'.

Before the European Union, cars and other goods were protected by tariffs. That's why you'd see mostly Volvos and Saabs in Sweden, Fiats and Alfas in Italy and Fords and Vauxhalls in Great Britain. When EU got tariffs dropped, many of the local favorites couldn't stand up to the invasion of 'foreign' brands which were better and now price competitive.

Volvos and Saabs couldn't make it without protectionism. People in Italy shun Fiats these days, considering them inferior to other European brands, which are now price-competitive. PSA Peugeot-Citroën is requesting a bailout because of declining sales and profits, as Frenchman happily drive Skodas and other eastern European offerings.

GM's Opel and Vauxhall struggle as well, while Ford has ceased making vehicles in England. Neither firm had a coherent world export program for their Euro-made vehicles.

Germany has withstood the vagaries of the EU quite well because manufacturers have long become experts in exporting. Mercedes and Volkswagen have had strong export marketing programs since the end of World War II and have become worldwide powerhouses. Porsche and BMW quickly followed.

Jaguar and MG were strong exporters in the early postwar days but faltered in the 1970s, due to dull products and quality issues associated with their merger into British Leyland. (posted 8-1-13, permalink)

Execrable Economist: I have always enjoyed Scott Adam's 'Dilbert' strip and had a really good laugh at a recent cartoon featuring a short, bearded, obnoxious "Nobel-winning" economist who looked suspiciously like Paul Krugman.

Kevin D. Williamson of National Review has said, "Ask a conservative who is the worst and most destructive writer on the subject of economics, and the answer is bound to be Paul Krugman."

The diminutive economist and op-ed columnist for the New York Times seems to be wrong much of the time. In 1998, he wrote, "By 2005 or so, it will become clear that the Internet's impact on the economy has been no greater than the fax machine's."

In August 2004, Bill O'Reilly really cleaned Krugman's clock on Tim Russert's interview show on CNBC. Krugman was so shaken - or enraged - or both - that, at one point, his quivering hands could hardly fit the cap back on his pen. And he was sweating like Roman Polanski at a Girl Scout jamboree. O'Reilly's style is often too bombastic for me but he was terrific on Russert, giving prophet-of-doom Krugman several well-deserved rhetorical punches in the nose.

Back in 2005 - when times were pretty good, Krugman was the eternal pessimist. At the time, tongue firmly in cheek, Jonah Goldberg remarked, "I could have sworn, reading Paul Krugman, that we were hair's width from a barter economy, where we eat grass and wake up to the sound of "bring out your dead!" every other morning."

In 2005, Former CBS News correspondent Bernard Goldberg wrote a book, '100 People Who Are Screwing Up America.' Guess who made the list? Paul K.

Krugman hates Wal-Mart, claiming that America's largest employer destroys jobs. He admits to being an unabashed defender of the welfare state.

Pauly K really does belong in the comics section of a newspaper. (posted 6-24-13, permalink)

Paging Mr. Ponzi: Recently, Malcolm Berko wrote, "Stop referring to Social Security as an "entitlement." SS is not an entitlement. Every time you or your spouse earned a paycheck, the employer sent Social Security 6.2% of it to an account under your or her name. Paging Mr. Ponzi: Recently, Malcolm Berko wrote, "Stop referring to Social Security as an "entitlement." SS is not an entitlement. Every time you or your spouse earned a paycheck, the employer sent Social Security 6.2% of it to an account under your or her name.

And each time you or your spouse earned a paycheck, the employer also sent SS a matching amount to your account. That's 12.4% per paycheck, and your spouse never received a shilling of it. You earned it! You paid for it! It's your money! It's not an entitlement!

The word "entitlements" is government-speak for the federal programs from which lots of folks receive support that they don't pay for. However, Congress is ill-advised to call Social Security an entitlement. Calling SS an entitlement is purposefully disparaging and places it on the same common field as food stamps, job training, free cellphones, etc."

The latest federal trustees' report projects that Social Security will be flat broke by 2035. The Social Security program faces $9.6 trillion in unfunded liabilities over the next 75 years, which is up $1 trillion from last year's projection of $8.6 trillion.

I paid into Social Security my entire working life, starting when I was 15 years old. Social Security is a promised annuity, which is greatly underfunded. All of the money paid in by a younger generation is immediately paid out as obligations to an older generation.

In the private sector, this is known as a Ponzi scheme. (posted 6-4-13, permalink)

Golden Cliff: Gold, the shiny commodity which sold for almost $2,000 per ounce a couple of years ago, has crashed.

Scott Grannis has written, "It looks like gold is on its way to re-linking to commodity prices, with a likely price target of $900-1000/oz." Maybe even lower, since overreaction at both ends of the scale is not uncommon in commodities markets. Scott Grannis has written, "It looks like gold is on its way to re-linking to commodity prices, with a likely price target of $900-1000/oz." Maybe even lower, since overreaction at both ends of the scale is not uncommon in commodities markets.

"In late 2008, gold began to overshoot commodity prices. Call it an "end of the world as we know it" trade. Gold was reacting to fears that the world's central banks were engaged in a massive money printing scheme that would result in hyperinflation, and/or a global currency collapse. Gold was also propelled higher by the Eurozone sovereign debt crisis, which many thought would lead to the demise of the Euro, and by fears of exploding sovereign deficits that might inevitably be resolved by a big increase of inflation."

Nevertheless, Monex is still running those gold-pushing television commercials, featuring the blonde spokeswoman with the upper-class British accent.

She is an Australian actress named Ros Gentle. Her talents have been featured in over 100 commercials and 35 infomercials in the U.S. and elsewhere. She has the uncanny ability to shed her Australian accent and mimic a stately Her Majesty's English, Cockney and a variety of American regional dialects such as Deep South. (posted 5-1-13, permalink)

More 'Finance & the Economy' postings can be found here.

copyright 2013-14 - Joseph M. Sherlock - All applicable rights reserved

Disclaimer

The facts presented in this blog are based on my best guesses and my substantially faulty geezer memory. The opinions expressed herein are strictly those of the author and are protected by the U.S. Constitution. Probably.

Spelling, punctuation and syntax errors are cheerfully repaired when I find them; grudgingly fixed when you do.

If I have slandered any brands of automobiles, either expressly or inadvertently, they're most likely crap cars and deserve it. Automobile manufacturers should be aware that they always have the option of trying to change my mind by providing me with vehicles to test drive.

If I have slandered any people or corporations in this blog, either expressly or inadvertently, they should buy me strong drinks (and an expensive meal) and try to prove to me that they're not the jerks I've portrayed them to be. If you're buying, I'm willing to listen.

Don't be shy - try a bribe. It might help.

|

|